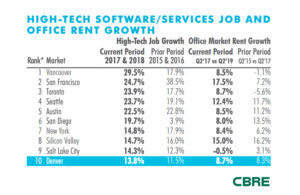

A new CBRE report affirms Denver as a top North American tech market, ranking the Denver/Boulder region 10th in high-tech job growth among the 30 leading North American technology markets. The Denver/Boulder region added 8,544 tech jobs from Q2 2017 to Q2 2019, which represents 42.2 percent of all new office jobs created during that time.

While the Denver/Boulder region’s high tech job growth advanced, Denver’s office rent growth actually moved down in the rankings to #15 (from #9 last year). The region’s office rents grew 8.7 percent over the two-year period of Q2 2017 to Q2 2019, reaching $28.43 per square feet in the second quarter of this year. While this marked a new record high for metro Denver, 8.7 percent growth is in the middle of the pack for leading North American tech markets. The three leading tech markets in CBRE’s analysis, San Francisco, Portland and Silicon Valley, all posted rent growth at or above 15 percent.

While the Denver/Boulder region’s high tech job growth advanced, Denver’s office rent growth actually moved down in the rankings to #15 (from #9 last year). The region’s office rents grew 8.7 percent over the two-year period of Q2 2017 to Q2 2019, reaching $28.43 per square feet in the second quarter of this year. While this marked a new record high for metro Denver, 8.7 percent growth is in the middle of the pack for leading North American tech markets. The three leading tech markets in CBRE’s analysis, San Francisco, Portland and Silicon Valley, all posted rent growth at or above 15 percent.

“A look at office rents in North America’s leading tech markets provides critical perspective. Here in Denver and Boulder we have watched office lease rates steadily climb, setting a new record high for eight consecutive quarters as of Q2 2019. While remarkable, our office rents are actually rising at a slower rate than many of North America’s leading tech markets. Our competitive cost to do business in hand with our region’s growing tech talent base is what is continuing to attract new tech firms to Colorado,” said Alex Hammerstein, senior vice president at CBRE and part of CBRE’s Tech and Media Practice in Denver.

Denver’s positive market fundamentals positioned it among the “growth leaders” quadrant of CBRE’s market power diagram. These markets, recognized for above-average job strength and office market performance, are targets for where potential value and growth will likely continue to occur.

“The North American tech industry has diversified its economic base as it has grown, expanding its presence in many Tech-30 markets,” said Colin Yasukochi, executive director for research for CBRE’s Tech and Media Insights Center and co-author of the report. “Meanwhile, large tech companies have been an ongoing source of demand; the 10 most active tech companies leasing office space since 2013 account for 27 percent of overall tech-industry leasing.”