DENVER — As new tech talent continues to emerge around the Denver metro area, the office market looks strong and steady, according to Cushman and Wakefield’s 1Q Denver Office Marketbeat report. Competition amongst Class B buildings is as intense as ever and limited supply of quality large blocks of space, in excess of 200,000 square feet, is becoming a significant challenge, not only for sizable growing Denver tenants, but to out of market users considering Denver.

Vacancy and Rental Rates

Vacancy and Rental Rates

Denver’s Central Business District (CBD) recorded a 10 basis-point (bps) decrease in direct vacancy to start the year, down to 16.2 percent at the end of the first quarter 2019. Overall vacancy followed suit, recording a 20 bps decrease quarter-over-quarter, to 18 percent. This decrease in vacancy is largely due to the uptown micro-market recording a 120 bps decrease in overall vacancy from the fourth quarter 2018 to the fi rst quarter 2019, to 16.3 percent, largely impacted by WeWork occupying 117,000 square feet (sf) at Wells Fargo Center.

Direct average gross rental rates increased 2.9 percent quarter-over-quarter, closing out the first quarter 2019 at $36.79 per square foot (psf). This increase was largely attributed to the delivery of the Prism Building as well as the increase in operating expenses and taxes that continues to drive up occupancy costs. Overall gross rental rates also grew quarter-over-quarter, increasing 2.3 percent to $36.71 psf at the end of the first quarter 2019. Class A and B product both recorded increases in overall gross rental rates, increasing 1.7 percent ($40.39 psf) and 3.6 percent ($31.49 psf), respectively, from the fourth quarter 2018 to the first quarter 2019. The Lower Downtown (LoDo)/Central Platte Valley (CPV) micro-market continues to command the highest rates in the CBD and metro-wide, ending the first quarter 2019 at $46.01 psf on a direct basis. This is largely due to the lack of available space throughout the LoDo/CPV micro-market with a 7.8 percent direct availability rate at the end of the first quarter 2019.

Leasing Activity

Leasing Activity

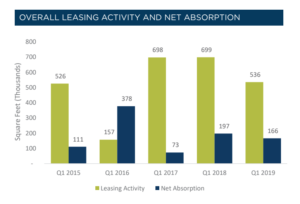

The CBD recorded just shy of 536,000 square feet (sf) of leasing activity during the first quarter 2019, down from the approximately 674,000 sf leased during the fourth quarter 2018. The largest lease for the quarter was Sunrun’s roughly 95,000 sf lease, as they move from Park Central to Manville Plaza. WeWork continues to lease large blocks of space, leasing another 61,000 sf in Civic Center Plaza, which marks their seventh location in the CBD. Net absorption remained positive for the ninth consecutive quarter, with over 166,000 sf absorbed during the first quarter 2019.

Construction

One building, The Prism, delivered approximately 95,000 sf of rentable office product to the Midtown micro-market, which was 25 percent preleased at delivery. Currently, the CBD has just over 1 million square feet (msf) of speculative office development under construction and is currently 0 percent preleased. This preleasing percentage is expected to rise, with 86 percent of the product currently under construction expected to deliver after 2019. These buildings should continue to provide strong preleasing at delivery, if the success of new construction during this expansion period continues.

Outlook

2019 is set to be another strong year for Denver’s CBD. Absorption should remain positive throughout the remainder of 2019 as previously leased space is occupied. As these occupiers move-in, vacancy should continue to decrease. Rental rate growth will continue to be modest with growing occupancy costs and the addition of new product, the catalysts behind these increases. The CBD’s lack of large available blocks of space will continue to hinder the market, with only two 100,000 sf blocks available in existing product currently on the market. With potential changing regulations within the oil and gas industry and Initiative 300, the CBD’s office growth could be halted. All eyes will continue to be on these legislative topics and what comes to fruition,

but those potential headwinds could impact the future of Denver’s CBD office market.

Graphics courtesy of Cushman and Wakefield