DENVER– CBRE is dispelling the myth that downtown Denver’s multifamily market is overbuilt. The commercial real estate giant’s latest report looks at how the balance between apartment supply and demand— the ratio of jobs to apartment units — reveals that downtown Denver is in fact underserved and additional apartment supply is needed.

Downtown Denver currently has 10,700 apartment units either under construction or in planning and there is the potential for supply to increase by 27 to 52 percent.

Downtown Denver currently has 10,700 apartment units either under construction or in planning and there is the potential for supply to increase by 27 to 52 percent.

“It’s easy to see a big number of apartments coming and feel skeptical of whether a city can sustain that level of supply. But when you look at where a healthy market should be in terms of its ratio of jobs to apartments, and then you see how far Denver has historically been off from that number, it provides needed perspective and in this case peace of mind,” said Matt Vance, economist and director of Research & Analysis with CBRE.

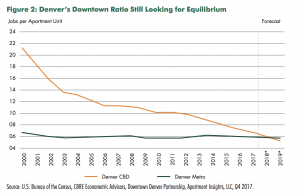

The ratio of jobs to apartment units indicates the number of new jobs—the primary driver of apartment demand in the U.S. —needed to absorb one additional apartment unit. In general, downtown urban cores have lower ratios than their respective markets, due to lower homeownership and smaller household sizes. This is the case in Seattle, where the downtown ratio has remained between 4.0 and 4.5 jobs per apartment for the past 15 years, while the Seattle metro-wide ratio has hovered around 5.5 jobs per apartment over the same period.

“Developers of downtown Seattle apartments have done a remarkable job of keeping pace with demand, maintaining a stable equilibrium and supporting healthy and sustainable multifamily property performance,” said Mr. Vance. “Alternatively, in Denver we see a downtown residential market that has historically struggled to keep pace with its growing employment base.”

According to CBRE, in 2000, Denver’s downtown jobs to apartment ratio was 21.3, more than four times greater than Seattle but new supply has pushed downtown Denver’s ratio lower over recent years, reaching 6.6 jobs per unit at the end of 2017. Although an improvement, Denver still stands in contradiction to the norm with a downtown ratio that is well above its metro-wide ratio of 5.9 jobs per apartment unit.

CBRE predicts that Denver can expect its ratio to reach 5.2 jobs per unit by year-end 2019, a number that is more in line with national trends.

“While the delivery of a large number of new apartment units in a short period of time can cause growing pains, Denver can rest assured that the data shows the supply is needed as our city continues to grow and mature,” concluded Mr. Vance.