Sustained demand from hyperscale users and emerging interest from AI companies is driving growth in Colorado’s data centers sector, according to a new report from CBRE.

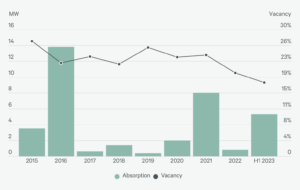

Metro Denver registered 5.3 megawatts (MW) of net absorption in the first half of 2023, a five-fold increase from the same period a year earlier. The market is home to 88.6 MW of total inventory with an additional 10.5 MW under construction. Sixty-six percent of the space underway is already pre-leased. Data center developers remain focused on Aurora and Colorado Springs, due to land and power availability, with an additional 6 MW under construction in Colorado Springs.

Hyperscale requirements have driven much of the market absorption over the past couple of years. Colorado saw its first multi-megawatt AI deal in the first half of 2023 with more demand circling the market.

“We are in the early innings of the demand curve from hyperscalers and AI companies. Colorado is already seeing an increase in large power requirements with densities pushing the limits of air-cooled systems, which are prevalent in Colorado. These requirements are forced to go to other markets because Colorado doesn’t yet have enough available supply, but there is interest from several developers to enter the market and capture the impending demand,” said Greg Vernon, senior vice president, CBRE Data Centers Solutions.

He added, “Tailwinds for Colorado include its power availability and pricing. Some of the nation’s largest data center markets are running into capacity limits, driving users to secondary markets like Colorado. And while Denver’s lease rates are rising, local utilities have introduced discounted rates on power via a tiered structure, which is helping position the metro area as cost competitive.”

National Trends

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 MW of data center supply currently under construction, reaching a new all-time high with more than 70% already preleased. At the same time last year, there was 1,830.3 MW under construction. In anticipation of future demand and to secure data center space at current pricing, companies are leasing space up to 36 months in advance of construction completion.

Absorption in the eight primary U.S. data center markets* remained resilient in H1 2023, totaling 468.8 MW, despite challenges within the supply chain. While supply increased 19.2% year-over-year, vacancy remains near a record low of 3.3%. Strong demand paired with a lack of available power and extended timelines have kept asking rental rates climbing. Average primary market asking rents rose to $147.80 per kW/month from $127.50 (a 15.9% year-over-year increase).

To view the Denver market insights, click here.