CommercialEdge just released its October office report analyzing the U.S. office market’s performance through September 2022.

Demand for flex office space continues to rise, pushed by hybrid work arrangements, growing interest from both CEOs and workers, and the increasing desire to avoid long-term leases. As such, the existing coworking and flex footprint is expected to surge, with growing numbers of developers, owners and brokerages entering this emerging sector.

“Given the flexibility and amenities coworking locations provide, there is real opportunity to align with what corporations are needing in future space decisions. We’re tracking around 120 million square feet of flexible space and expect that number to rise significantly in the future,” Peter Kolaczynski, CommercialEdge senior manager says.

Key findings from the report:

-

The average U.S. office listing rate stood at $37.67, ticking down 2.4% year-over-year

-

Up 180 basis points year-on-year, the national vacancy rate rested at 16.6%

-

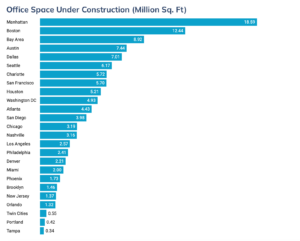

Under-construction office space totaled 139.1 million square feet in September

-

$69.3 billion in office sales were closed in the first three quarters of the year

-

Under-construction office space in Denver totaled 2.21 million square feet in September

- Rents for Denver office space trended up, albeit at a modest 0.6% year-over-year, resting at $30.14 per square foot.

Check out our full report here: https://www.commercialedge.