While the coronavirus will weigh on the U.S. economy in the first quarter, growth should be sustained. According to the Marcus & Millichap special report on the virus outbreak, expectations of weaker exports, reduced tourism and supply chain-related shortfalls will moderate the pace of economic growth. However, low unemployment and comparatively strong consumption levels should off set the headwinds unless the outbreak amplifies significantly or confidence levels drop dramatically.

Summary

- The spread of the coronavirus has sparked fear, causing a flight to safety that has driven interest rates to a record low.

- The flow of capital from the stock market into bonds has driven the 10-year Treasury down by more than 70 basis points in two weeks.

- Historically, pandemic outbreaks such as SARS, the H1N1 “swine flu,” and the “avian flu” or “bird flu” generated short term market instability that moved toward stabilization over the following three to six months.

- The volatility of equity markets reiterates the stability of commercial real estate and the compelling 5-7 percent yields.

- Real estate is a long-term investment offering significantly less volatility than most other investment options. Although

there is uncertainty in the market today, real estate investors must keep their eyes on the horizon.

Commercial Real Estate Outlook

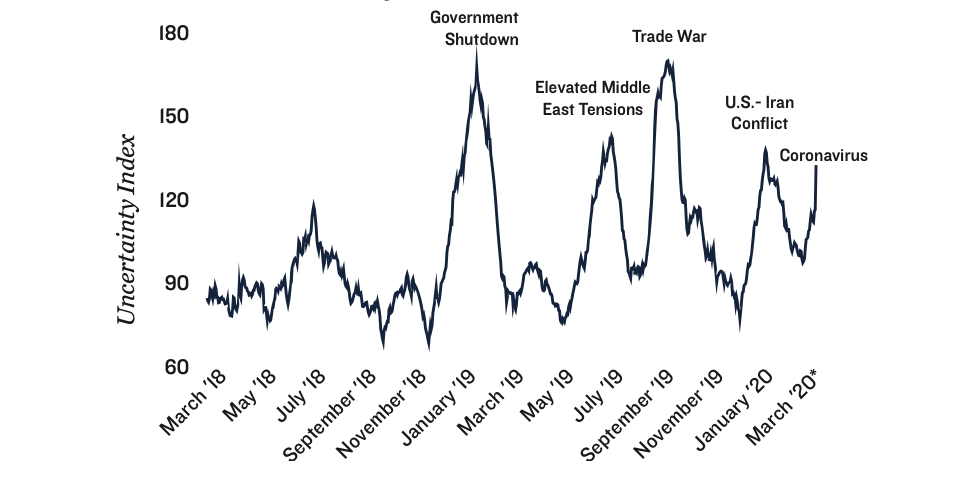

Window for investor action could change rapidly. Uncertainty surrounding the expanse and impact of the coronavirus spawned investor uncertainty that sparked the flight to safety. Investor fears, fueled by the limited insights available from leading health organizations as the new virus spread, continue to weigh on the market. As clarity emerges and actions are taken to mitigate the risks from the virus, financial markets will likely begin to stabilize. Past pandemic events such as the swine flu, the bird flu and SARS also generated short-term market volatility that stabilized within 90-180 days on average. While the trajectory of the coronavirus could certainly be different from past pandemics, pharmaceutical firms have engaged in collabo- rative efforts to move a vaccine to trials as soon as April, offering the prospect of a resolution.

Sound fundamentals support steady performance. Real estate supply and demand generally remain in balance, supporting stable occupancy levels and a steady outlook. Assuming a worst-case pandemic scenario is avoided, the pace of job creation and economic growth will likely taper but remain positive. This will sustain real estate fundamentals over the course of the year, delivering a relatively solid outlook.

Investment Trends

Despite the barrage of headlines focused on the COVID-19 and the impact this has had on financial markets, real estate investment activity remains positive. The steep decline of interest rates to unheard of levels will support refinance and acquisition activity. Though many lenders have widened their spreads over the risk-free rates, investors have been able to lock in debt in the 3 percent range depending on the borrower’s credit, asset quality, location, etc. The reduced cost of capital has not translated to higher property valuations or lower cap rates as many sellers hoped because the new coronavirus does create additional uncertainty for many buyers.

Apartments:

The apartment market will continue to deliver favorable performance as housing demand outpaces new supply. The coronavirus will have little direct impact on the demand for housing over the short term. Vacancy rates ended 2019 at 4.2 percent and are expected to rise modestly in 2020 as the market digests the addition of 300,000 new Class A units. Class B and C apartments, with vacancy rates near historic record-low levels, will continue to deliver strong results.

Hospitality:

Hotels will likely face the most direct impact from the new corona- virus outbreak as businesses and tourists reconsider travel plans and restrictions are placed on mobility. Properties with a significant Asian customer base will face softening demand, but venues catering to conferences and major events could also be impacted if businesses and organizations cancel these gatherings. The average 2019 occupancy rate was 66.2 percent, near a record high, so while the virus will likely weigh on performance, the sector should remain above the 30-year average occupancy of 62.5 percent.

Office:

Demand for office space should see little direct impact from the coronavirus outbreak over the short term as sturdy office-using job creation and the tight labor market support demand. The pace of office construction remains nominal in most markets, and absorption is expected to maintain paradoy with deliveries in 2020, keeping the national vacancy average rate stable at 13.0 percent.

Industrial:

While the flow of goods from China may taper over the short term due to the shutdown of several Chinese factories, this poses little risk to industrial space demand. West Coast port markets’ industrial vacancy rates remain exceptionally low and face modest development risk. Distribution hubs like Riverside San Bernardino may face some softening as a wave of big-box warehouse development enters the market. Some companies may postpone commitments for large space blocks at major warehouse facilities as they cautiously monitor the economic outlook and await additional information on the supply chain outlook.

Retail:

In general, retail real estate demand should remain stable, but some coronavirus-centric risks will emerge. Potential product shortages could weigh on retailer performance while an aversion for public spaces could hamper social engagement spaces like restaurants, entertainment venues and fitness facilities. Retail locations in tourist destinations could also face reduced traffic during this uncertainty. As a result, some companies may put ex- pansion plans on hold until activity levels revive, which will weigh on short-term absorption.

Graphic courtesy of Marcus & Millichap