According to a whitepaper published by Black Creek Group, an experienced real estate investment management and development firm with an office in Denver, today’s bear market paired with a low rate environment have exposed the shortcomings of traditional portfolio construction, and investors need new investment options to achieve positive long-term results.

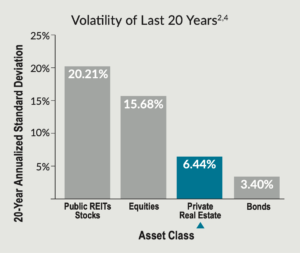

A portfolio inclusive of private real estate has historically generated better risk-adjusted returns — or returns relative to the investment’s level of risk. Private real estate has delivered lower volatility, while providing higher annualized returns than equities and bonds, making its risk-adjusted returns historically more favorable than other asset classes.

The white paper examines the role of private real estate in investor portfolios in today’s environment. Here are few highlights.

- Over the last 40 years, only two out of the last five major recessions have corresponded to downturns in commercial property values.

- Over the last 20 years, private real estate has exhibited historically low or negative correlation to equities, bonds and publicly traded real estate investment trusts (public REITs), meaning private real estate is less influenced by market volatility.

- Private real estate’s average risk-adjusted returns have been the highest over the last four decades compared to that of equities and bonds, demonstrating its ability to outperform through various market cycles.

To read the full whitepaper CLICK HERE