If the industry buzz is true that there will be at least two more interest rate increases, and these increases are above 6.5%, these costs [for paying a Yield Maintenance penalty] will be even higher.

By: Eitan Weinstock, Senior Analyst at Yield Maintenance Consultants

There is talk in the industry and media about a June interest rate increase if economic trends continue. The fear of a rate hike is increasing the number of commercial real estate owners who are interested in prepaying their commercial loans to lock in long-term fixed financing. Existing market conditions lay the groundwork for an especially popular time to prepay existing debt while interest rates remain historically low.

Many owners dismiss prepayment as impractical, especially those with several years remaining until loan maturity. Prepayment penalties such as Yield Maintenance have built up a negative connotation among owners and brokers, but during certain economic conditions, paying prepayment penalties can actually be well worth it for most commercial property owners.

Yield maintenance is most often used in commercial real estate as the prepayment requirement on Life Insurance Company and Agency loans. Specifically, Yield Maintenance is the process of releasing a commercial property from the lien of the mortgage by effectively paying the lender all remaining interest on the loan, at a present value discount. Once a Yield Maintenance penalty is paid, the lien is released from the real property, allowing the borrower to simultaneously either refinance or sell their property free and clear.

Yield Maintenance costs are tied directly to Treasury rates — the lower the Treasury rates, the higher prepayment costs. Since 2008, Yield Maintenance costs have ranged from 4-6 points per year remaining on the loan, leading many borrowers to ‘sit’ on their loans rather than sell or refinance. However, Moody’s reported a significant rise in Yield Maintenance payoffs in 2015, increasing 140% from 2014; and what’s more, 2015 data shows borrowers are paying off loans with longer remaining terms than in 2014. Even borrowers with many years remaining on their loans, are taking the opportunity to further lock-in low long-term interest rates.

While penalties still range from tens of thousands to tens of millions of dollars, many borrowers can actually save considerable amounts by paying Yield Maintenance penalties today. For borrowers looking to take advantage of today’s historic rates, prepayment presents the opportunity to avoid 5.5-7.5% rates in a year or two, and instead lock-in 4-5% rates for a decade or more. In many cases, prepaying today means negating interest rate risk at a minimal cost.

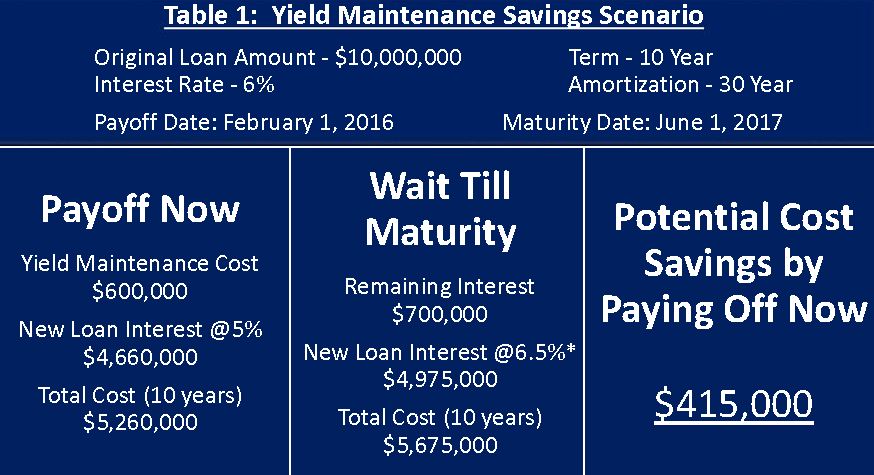

For example (per Table 1) for a borrower with a loan with an original principal balance of $10,000,000 originated in June of 2007 at a 6% interest rate, the potential cost savings from paying a Yield Maintenance penalty now will be approximately $415,000, based on current interest rate forecasts. As illustrated in the table, the total cost to prepay today will be approximately $600,000, while savings from locking-in a new 10-year loan at 5% interest rather than 6.5% interest would be approximately $1.015mm, resulting in a net profit of $415,000. If the industry buzz is true that there will be at least two more interest rate increases, and these increases are above 6.5%, these costs will be even higher.

For example (per Table 1) for a borrower with a loan with an original principal balance of $10,000,000 originated in June of 2007 at a 6% interest rate, the potential cost savings from paying a Yield Maintenance penalty now will be approximately $415,000, based on current interest rate forecasts. As illustrated in the table, the total cost to prepay today will be approximately $600,000, while savings from locking-in a new 10-year loan at 5% interest rather than 6.5% interest would be approximately $1.015mm, resulting in a net profit of $415,000. If the industry buzz is true that there will be at least two more interest rate increases, and these increases are above 6.5%, these costs will be even higher.

Yield Maintenance penalties requiring significant notice and exact closing timelines allow defeasance services companies to remove the stress for owners and brokers by working to ensure that all requirements have been met and that there are no potential last-second mistakes that can blow up a deal.

Graphic credit: courtesy of Yield Maintenance Consultants

Eitan Weinstock is the Senior Analyst at Yield Maintenance Consultants in Los Angeles. For more information, contact Eitan at EWeinstock@YieldMain.com or at (800) 754-9624. For a free calculation of your Yield Maintenance costs, visit YieldMain.com.