DENVER – When it comes to premium office space across the United States and Canada, creative firms are doing what they do best: driving change. JLL’s 2017 Skyline shows that creative’s boomerang to this coveted space and the eighth straight year of occupancy growth are contributing to record rents and a landlord-friendly market. In Denver, development continues to hum along with 1.1 million square feet delivered in the past two years and another 1.1 million square to be delivered this year.

Skyline is JLL’s annual look at office space within some of the tallest buildings in 57 markets across North America. Some highlights from this year’s edition include:

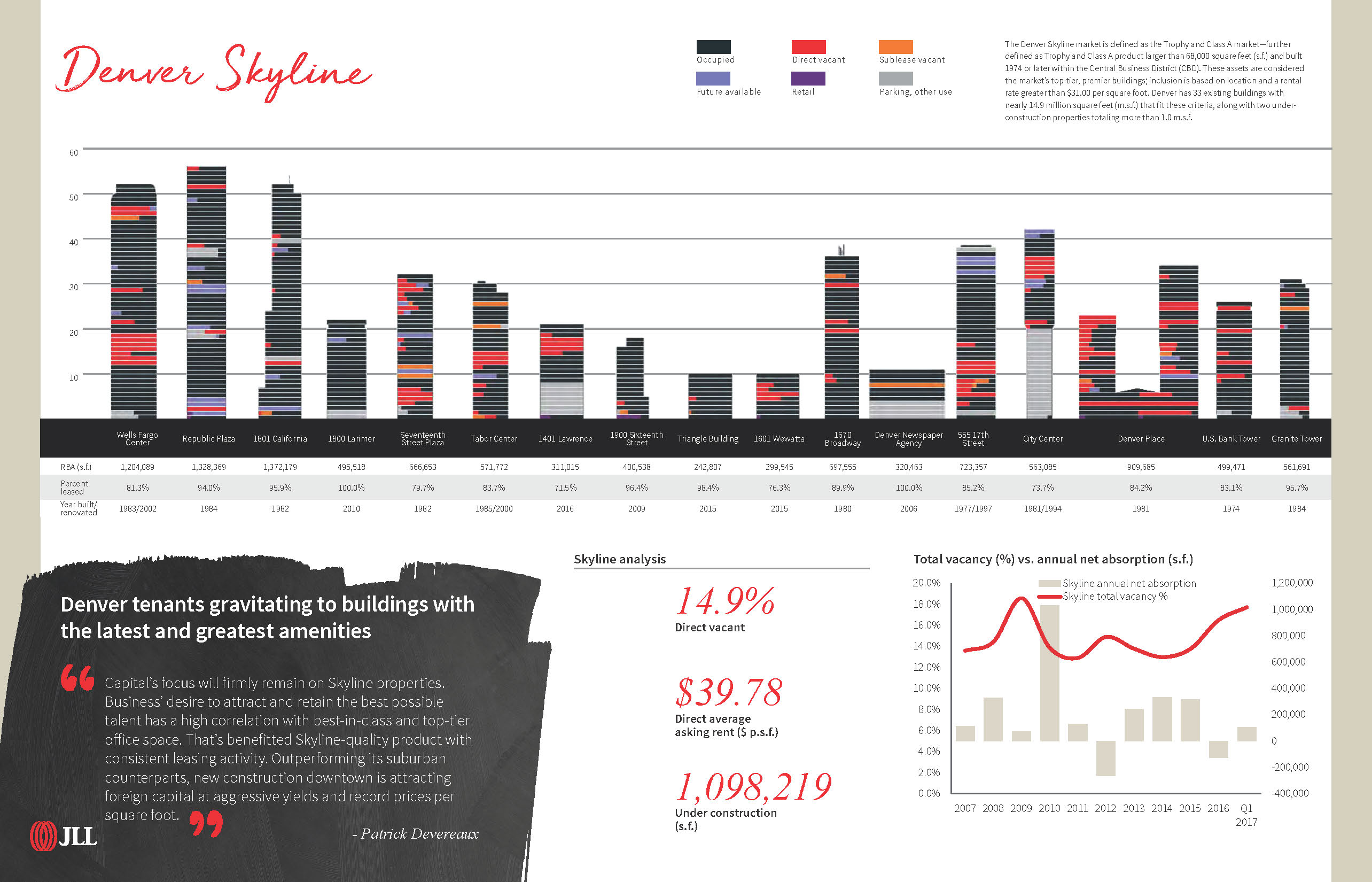

- Skyline vacancy within the Denver market remains just above the national average at 15.9 percent, with vacancy of trophy buildings – those ultra-premium office towers within a skyline – at just 14.9 percent.

- Rents hit a record $39.78 per square foot.

- Buyers will remain focused on skyline properties

- The construction pipeline remains healthy, but shows signs of slowing.

A Shifting Leverage

During the last six to nine months, our Skyline set’s occupancy rate fell to its lowest level in some eight years—a cyclical low at just around 82 percent. It’s not necessarily surprising when you consider the general dynamics taking shape within the overall Denver office set: market momentum continues to shift toward more tenant-favorable, thanks in no small part to the introduction of new inventory. Within the CBD, nearly every square foot presently under construction or delivered so far this year is Skyline-quality product, and, for the third consecutive year, we’re north of a million square feet being built right now. Three straight years of 1-million+ being built—we think that unprecedented since we started tracking Skyline. In other words, tenants willing to pay have more options in crème-de-la-crème buildings than ever before.

In turn, landlords are making concessions, even if they’re not lowering face asking rates. Work allowances and free rent offerings remain elevated while vacancy has ticked up. Still, they’re building, and occupiers are showing up. Absorption’s rebounded back into the black, and pre leasing figures are at their highest since 2012.

Despite the lofty-seeming number, direct asking rents within Skyline-quality product haven’t moved much. Occupiers, believe it or not: adjusted for inflation today’s ask ($39.78 p.s.f.) is only about 5 percent higher than a full decade ago.

A rising tide lifts all boats

Tenants still want that Skyline caché, which is why rents rest at $39.78 per square foot on average. For those coveted few trophy spaces, that premium goes to $41.46 per square foot. 1144 15th Street, Denver’s first skyscraper in 30 years, already boasts a preleasing rate of 37% and 16 Chestnut, slated to be completed in 2018, is 81% preleased.

Buyers selectively target the skyline

“Capital’s focus will firmly remain on Skyline properties,” said Patrick Devereaux, Executive Vice President with JLL Denver’s Capital Markets Group. “Business’s desire to attract and retain the best possible talent has a high correlation with best-in-class and top-tier office space. That’s benefitted Skyline-quality product with consistent leasing activity. Outperforming its suburban counterparts, new construction downtown is attracting foreign capital at aggressive yields and record prices per square foot”

So, just how much do investors love the skyline?

- Skyline acquisitions were up by more than $1.2 billion in 2016, while sales in the broader office market fell by nearly 10 percent – the sector’s first decline since 2009.

- Investors are increasingly looking to secondary markets for skyline acquisitions. Ten secondary markets surpassed $300 million of total volume (not just skylines) in 2016. Atlanta, Dallas and Miami led the way.

- Offshore investment increased to 40.3 percent of total skyline volume in the first quarter of 2017.

- Forty-two trophy assets were traded in 2016, increasing volume by $7.2 billion year-over-year.

Getting quieter on the construction front

A healthy 1.1 million square feet of skyline space remains in the construction pipeline, but activity is slowing since the end of 2016. The delivery of several large projects and a tightening in construction lending are the main factors.