DENVER — According to a new report from CBRE, momentum for additional construction of U.S. warehouses is not likely to wane because the vast majority of the country’s warehouse stock is decades old and ill-suited for the demands of e-commerce. Denver’s warehouse age is even older than the U.S. average, coming in at 36 years old.

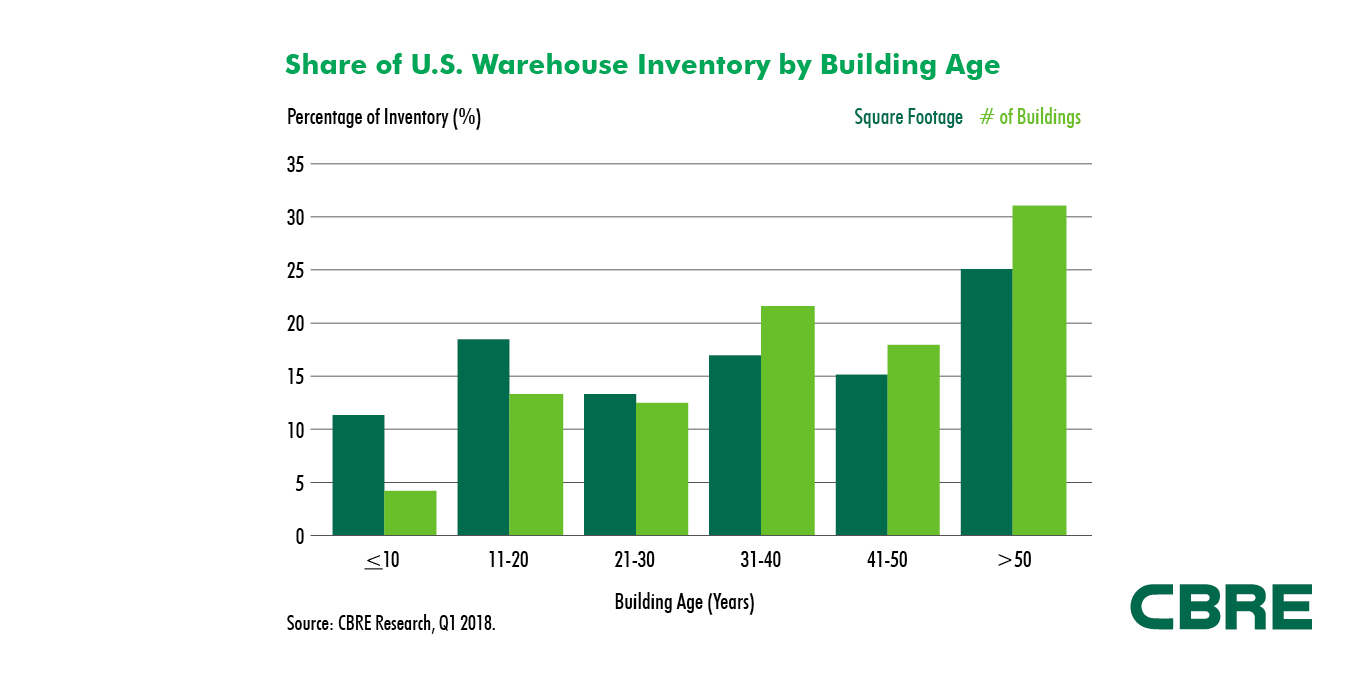

While it may appear that developers have raced to erect warehouses and distribution centers in recent years, the new supply’s impact within the wider scope of the entire U.S. warehouse market has been muted. Despite roughly 1 billion sq. ft. of new construction over the past decade, the average age of warehouses rose to 34 years from 26 in that span. That’s partly because that new construction amounts to only 11 percent of the entire 9.1 billion-sq.- ft. inventory.

“With 4.7 million square feet of industrial space underway in Denver as of the end of the first quarter, we are making progress toward meeting the high demand from e-commerce/distribution users. We are still recovering, however, from a lack of industrial construction during the recession, and that combined with our aging inventory has created a very competitive environment for industrial distribution tenants in Denver,” said Daniel Close, vice president with CBRE Industrial & Logistics Services in Denver.

CBRE analyzed data from 56 major U.S. markets and found that most facilities built prior to the mid-2000s have limitations that preclude their use for e-commerce distribution, such as low ceilings, small footprints, uneven floors and inadequate docking. In contrast, modern facilities with larger footprints, high ceilings and close proximity to major population centers are in strong demand. Three quarters of U.S. warehouses that went under new leases in 2016 and 2017 were buildings constructed within the past five years.

CBRE analyzed data from 56 major U.S. markets and found that most facilities built prior to the mid-2000s have limitations that preclude their use for e-commerce distribution, such as low ceilings, small footprints, uneven floors and inadequate docking. In contrast, modern facilities with larger footprints, high ceilings and close proximity to major population centers are in strong demand. Three quarters of U.S. warehouses that went under new leases in 2016 and 2017 were buildings constructed within the past five years.

Just keeping the industry’s average building age constant would require the construction of 275 million square feet of warehouse and distribution-center space annually. Actual construction has averaged 100 million square feet annually in the past decade, including a peak of 183 million square feet last year.

“E-commerce has created demand for a new type of warehouse with different dimensions, locations and capabilities than what most of the existing U.S. supply offers,” said David Egan, CBRE global head of Industrial & Logistics Research. “Given that only a small portion of the overall market is truly modernized, there is a strong case for new construction and redevelopment of outdated facilities in many markets.”

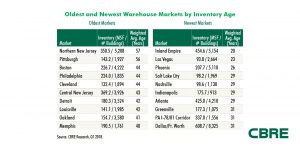

The breakdown of markets with the oldest and youngest average ages of warehouse stock tends to fall along geographic lines. Many of the oldest markets are in the Northeast, led by Northern New Jersey with an average warehouse age of 57, Pittsburgh (56), Boston (44) and Philadelphia (44). The youngest markets mostly are in the West and South, led by California’s Inland Empire (20 years), Las Vegas (23), Phoenix (26) and Atlanta (29).

Denver’s average warehouse age landed in the middle of the pack at 36 years.