According to Marcus & Millichap’s 2020 Multifamily Investment Forecast, Colfax Avenue remains the common denominator of many apartment deals as the corridor provides investors wide-ranging dynamics to fit various investment criteria.

Colfax Avenue remains the common denominator of many apartment deals as the corridor provides investors wide-ranging dynamics to fit various investment criteria. The eastern section in North Aurora provides favorable price points to many investors with per unit values averaging about $120,000 and cap rates reaching the mid-7 percent realm. Proximity to UCHealth keeps rental demand strong in this area as vacancy hovers under 4 percent.

Moving west, the Capitol Hill neighborhood is highly targeted due to its adjacency to downtown and relatively affordable price points. Buyers also zero in on North Lakewood, where the recently completed light rail extension has boosted the area’s transit connectivity to downtown, propelling apartment demand throughout the West Colfax corridor. Here, cap rates generally sit in the mid-5 to upper-5 percent range, in line with the metro average.

An excellent example of Colfax Avenue’s appeal is the recent sale of Luxe at Mile High, a newly-constructed, 382-unit multifamily community located at 3200 West Colfax Avenue in Denver, which sold for $145 million.

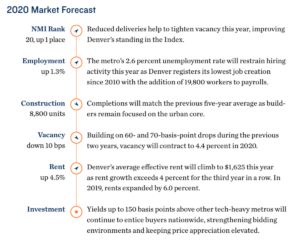

Looking at Denver’s multifamily forecast overall, the city’s growing tech market remains a key driver behind its apartment deliveries. An influx of high-wage jobs from companies such as Amazon and Slack is prompting developers to deliver luxury apartments to the urban core. Downtown Denver and its surrounding neighborhoods will receive more than half of the metro’s new supply in 2020, highlighted by several 300-plus unit complexes.

Looking at Denver’s multifamily forecast overall, the city’s growing tech market remains a key driver behind its apartment deliveries. An influx of high-wage jobs from companies such as Amazon and Slack is prompting developers to deliver luxury apartments to the urban core. Downtown Denver and its surrounding neighborhoods will receive more than half of the metro’s new supply in 2020, highlighted by several 300-plus unit complexes.

Despite the wave of upscale apartments, Class A vacancy has dipped to the mid-4 percent range, its lowest level in four years. The Class B and C segments boast even tighter readings in the low-4 and high-3 percent bands, respectively.

Sustained job creation in service-oriented fields and ultra-tight unemployment will remain a boon to workforce housing this year, keeping upward pressure on rent growth for these properties. In the past five years, the Class C average effective rent increased 41 percent, while the Class B measure rose 30 percent.