The Denver-Aurora-Boulder metro area is one of the most-balanced life sciences markets in the nation, according to a new report from CBRE. The region saw only moderate increases in lab vacancy and asking rates in the fourth quarter, and a growing pipeline of lab projects under construction is poised to meet nearly 1 million square feet in life sciences tenant demand.

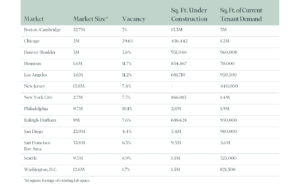

Lab vacancy across the metro area rose to 5.6% in the fourth quarter, up from 2.0% a quarter earlier. Vacancy rose across most of the 13th largest U.S. life sciences markets tracked by CBRE, now averaging 5.7% nationally, which is still below pre-2021 levels.

The greater Denver region remains one of the more-affordable U.S. life sciences markets, with average asking rents at $60 per sq. ft. in the fourth quarter, up from $57 in the third quarter. That’s in comparison to average rates of $99 in Boston/Cambridge, $76 in San Diego and $72 in the San Francisco Bay Area, the nation’s three largest life sciences markets by lab/R&D inventory.

Despite a tapering in venture capital funding in 2022, demand for life sciences real estate persisted in Metro Denver. There were 21 companies looking for a cumulative 960,000 square feet of lab/R&D space as of the end of the fourth quarter. The region’s construction pipeline is well positioned to meet the demand; Ten projects are currently underway that will deliver over 930,000 square feet of new life sciences space.

With nearly 65% of the construction pipeline already spoken for, Metro Denver/Boulder boasts the highest pre-leasing rate among all major U.S. life sciences markets.

“The high amount of pre-leasing activity in Metro Denver shows the confidence life sciences companies have in their ability to grow their operations in Colorado. The greater Denver-Aurora-Boulder region has long held a competitive advantage in terms of talent, relative affordability, and geography, and now our growing inventory of high-quality life sciences real estate is cementing that leadership position,” said Erik Abrahamson, senior vice president, CBRE.

National Landscape

National metrics gauging the life sciences sector varied in the fourth quarter as the industry normalized after robust growth in 2021 and much of 2022. Life sciences employment growth slowed from earlier rates but still progressed at a 4% year-over-year pace. Venture capital funding rebounded in the fourth quarter after three consecutive quarterly declines. Lab space under construction nationally grew to 40.3 million square feet in the fourth quarter, up roughly 8% from the third quarter. Meanwhile, demand for space declined by 8.4% to 18.5 million square feet.

Unlike Metro Denver, new supply of life sciences real estate is outpacing demand in most of the nation’s largest life sciences markets.