CommercialEdge just released its loan maturity report examining why Class B assets are more likely to default in light of the ongoing flight-to-quality trend that favors Class A spaces. The once-stable office sector is still grappling with lingering challenges created by the pandemic, as remote work continues to gain permanence and office space demand continues to fall, driving vacancy rates to new heights.

Weakened office fundamentals and a high-interest-rate environment have made investors and lenders wary of office assets, especially those considered to be functionally obsolete. The overall uncertainty has thus cast shadows on traditional refinancing strategies for properties approaching loan maturity.

Loans on 18.1% of Class B offices are set to mature between 2023 and 2026 across the country. Atlanta leads the U.S., with 29.8% of its Class B office spaces subject to expiring loans.

Key Takeaways:

- Loans on 19.4% of office properties will mature between 2023 and 2026 across all classes

- At 29.8%, Atlanta has the highest percentage of soon-to-mature Class B office loans across the country

- Denver’s 290 maturing Class B loans tied to 20 million square feet make up nearly two-thirds of all upcoming office debt in the metro

- Loans on 25% of Pittsburgh’s Class B offices to face expiring loans, the highest percentage in the Northeast

- By square feet, Chicago ranks third in the nation, with 25.5 million square feet of Class B office space subject to maturing loans between 2023 and 2026

Tech-Driven Denver, Seattle to Face More Challenges from Class B Loans

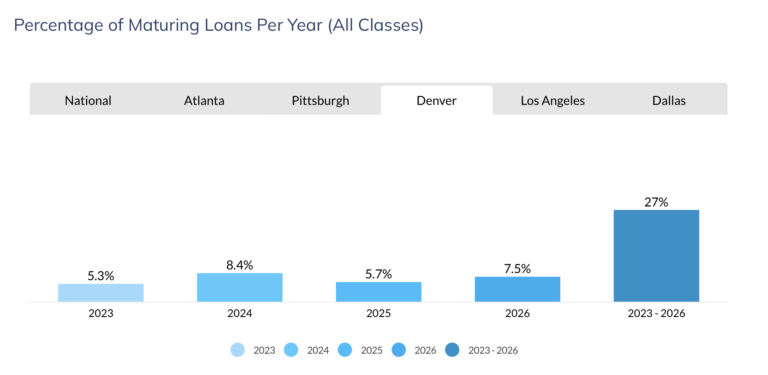

In the West, markets with the highest percentage of maturing Class B office loans include once-thriving tech markets disproportionately impacted by the pullback of tech firms. Denver is currently leading the region, with 26.1% of its stock subject to loans on Class B spaces due between 2023 and 2026. Specifically, the 290 maturing loans tied to 20 million square feet of Denver’s Class B office space make up nearly two-thirds of all upcoming office debt in the city. The market may also face additional distress due to its high vacancy rate, which stood at 20.8% in August.

Seattle is another tech market grappling with high vacancy rates (22.4% in August), and a significant portion (19%) of its Class B office space approaching maturity between 2023 and 2026. As things stand, it appears that 2024 and 2025 will be the most challenging for the market, with 5.3% and 7.3% of Seattle’s Class B office loans reaching maturity. By comparison, only 2% of debt is due this year and another 4.4% will reach maturity in 2026.

The outlook might be less pressing for Western markets like San Diego and the Bay Area (excluding San Francisco), which have a lower percentage of Class B office stock subject to maturing loans between 2023 and 2026: 14.1% and 16%, respectively. Their thriving life science sectors could also contribute to San Diego and the Bay Area (Solano, Contra Costa, Alameda and Santa Clara counties) having an easier time in the near future.