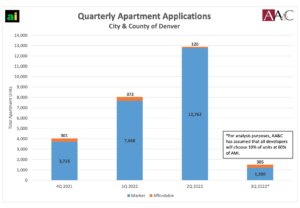

According to the Apartment Association of Metro Denver, applications for new apartment development declined by a dramatic 88% in the three months since a new Denver affordable housing ordinance went into effect on July 1, 2022.

Denver City Council approved a plan called expanding housing affordability, an ordinance that now requires new residential developments of 10 units or more to designate eight to 12 percent of the units as affordable to those making 60% of AMI, area median income.

Cary Bruteig and Scott Rathbun of Apartment Appraisers, Inc. released this graph that shows the decline in permit applications to the City and County of Denver after implementation of the new ordinance: