By the end of March, the rapidly evolving COVID-19 pandemic had slowed or halted nearly all Denver businesses. Several sectors with a notable corporate presence in Denver, including retail, transportation, and leisure, have suffered significantly to date. As the forecast of a recession in the U.S. appears increasingly likely, Denver’s market dynamics have the potential to be dramatically altered. According to Savills, one of the world’s leading real estate service providers, office availability is expected to rise this year while asking rents will see significant downward pressure due to slackening demand for space.

Availability increases across market; asking rents continue to grow, but likelihood exists for repricing in some submarkets

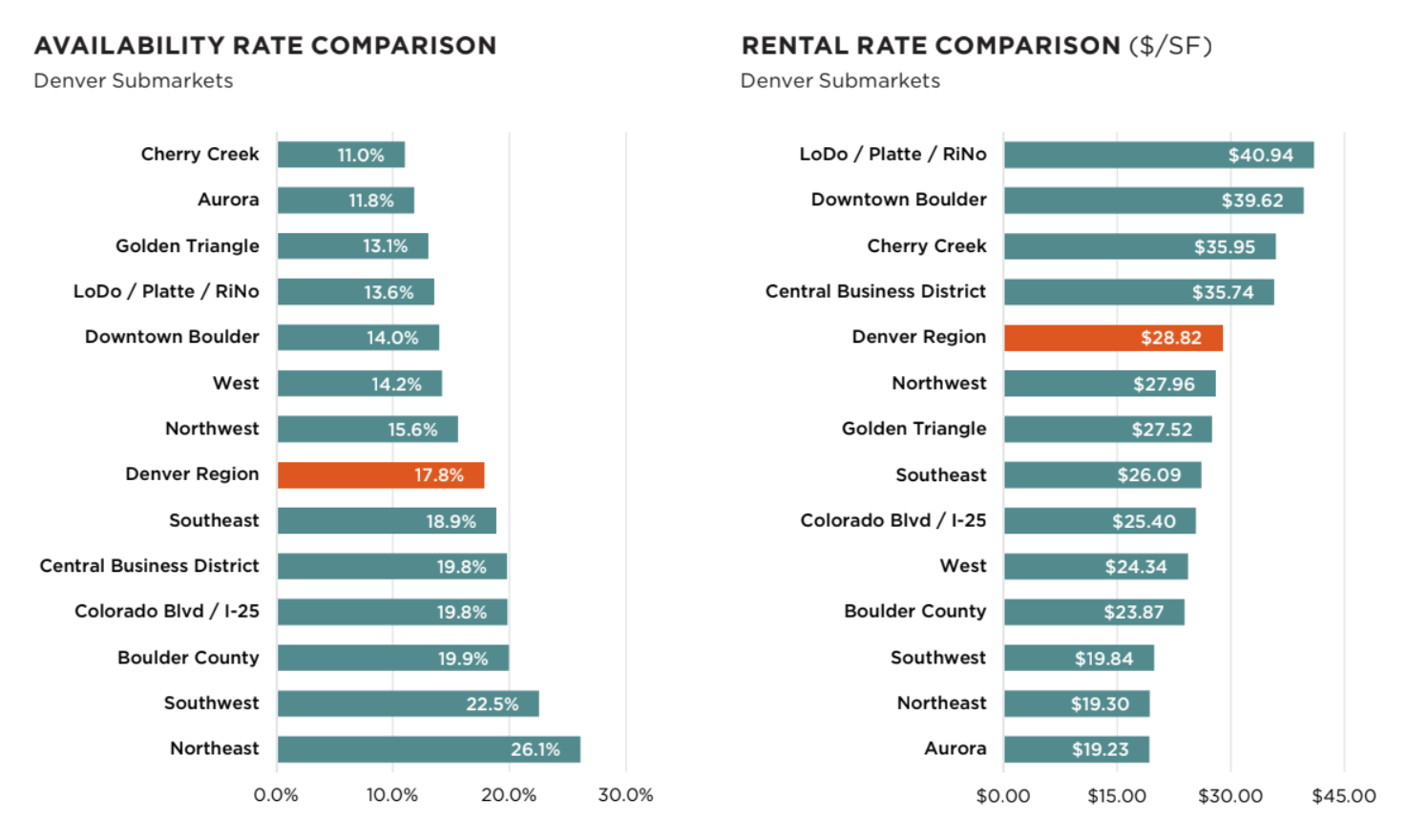

Ahead of any COVID-19 related impact, overall availability increased for the second consecutive quarter, finishing at 17.8% and marking a 30-basis-point increase over the preceding quarter. The LoDo / Platte submarket saw a surge of space come to market, increasing availability to 13.6% (up 230 basis points).

Likewise, availability in the Central Business District (CBD) surged 110 basis points to 19.8%. While downward pressure should at least flatten rental rate growth in the near term, Denver asking rents increased in the first quarter, rising 1.9% from last quarter to $28.82 per square foot (psf).

Transaction volume slows prior to beginning of economic pullback; tech firms active in Q1

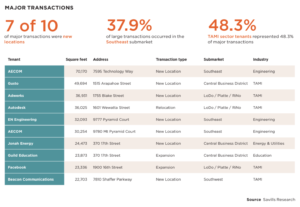

Leasing activity this period totaled 1.5 million square feet (msf), the lowest quarterly volume since early 2016. Deal volume is expected to further slow in the near team as occupiers take stock of the COVID-19-related impact on their businesses. Prior to the crisis, the technology sector was notably active in the market, with four of the top ten leases of the quarter signed by tech firms.

Among the market’s largest deals completed this period, AECOM committed to a combined 100,424 square feet (sf) at 7595 Technology Way and 9780 Mt. Pyramid Court, in the Southeast submarket. Also, Gusto signed a 49,694-sf sublease at 1515 Arapahoe Street, across the street from their existing location at Tabor Center.

KEY STATISTICS

• Increased availability and at least a flattening of rental rate growth is anticipated as a result of COVID-19, but the intensity of the disruption to the market’s fundamentals is still to be determined

• Landlord concessions including rent abatement, tenant improvement allowance, and term flexibility are likely to increase before any significant drop in asking rents

• Once the turbulence passes and the market enters a recovery cycle, occupiers will be presented with real opportunities to recast their real estate cost structure