CBRE just released its Q2 reports on Metro Denver’s office and industrial property sectors. Office sublease availability remains elevated but a recent decline indicates signs of leveling off. At the same time, a robust industrial leasing activity underscores Denver industrial’s resilience.

Q2 2023 Metro Denver Office Highlights

- After reporting record-breaking levels for the past three quarters, sublease availability dropped 3.2% quarter-over-quarter to 6.4 million sq. ft.

- The development pipeline remained at 2.4 million sq. ft.

- Negative 140,800 sq. ft. of direct net absorption was posted in Q2 2023, a notable improvement from the negative 384,600 sq. ft. recorded in Q1 2023.

- Leasing activity totaled 1.1 million sq. ft. in Q2 2023, marking a 22.4% increase quarter-over-quarter and closely mirroring the level of activity seen a year earlier.

- Investment activity improved in Q2 2023, totaling $253.6 million ($304.39 per sq. ft).

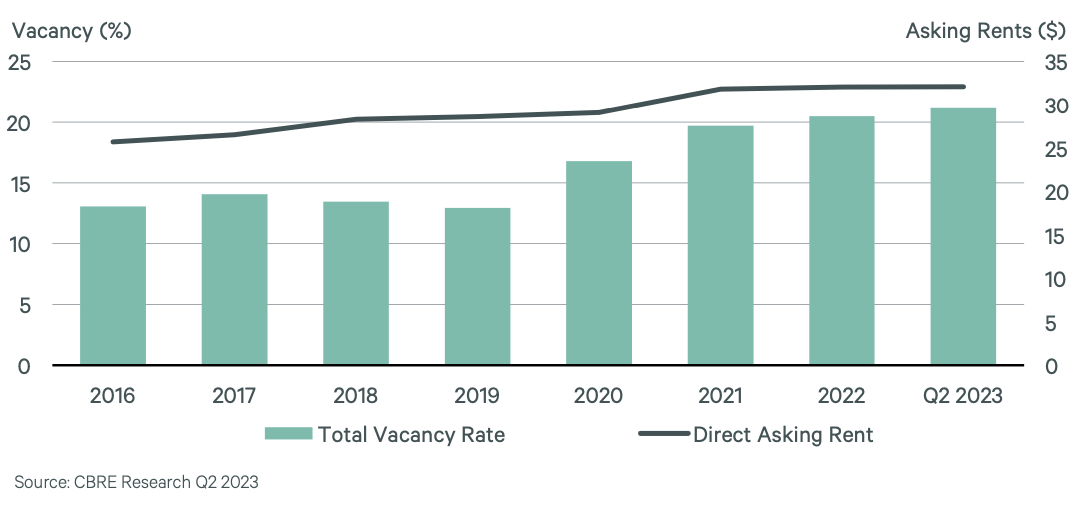

- Total vacancy increased 10 basis points (bps) quarter-over-quarter and 120 bps year-over-year to 21.2%. Direct vacancy saw a similar quarterly increase of 10 bps to 18.0%.

- The overall average direct asking rent posted a marginal increase of 0.3% quarter-over-quarter but a decrease of 0.2% year-over-year to $32.11 per sq. ft FSG.

Q2 2023 Metro Denver Industrial Highlights

- Total leasing volume transacted in metro Denver climbed to over 2.9 million sq. ft., a 73.1% quarter-over-quarter increase.

- Over 1.6 million sq. ft. of positive net absorption was posted, pushing year-to-date total net absorption to over 2.4 million sq. ft.

- Development activity decreased 18.0% quarter-over-quarter with 8.2 million sq. ft. under construction at the end of Q2 2023.

- Metro Denver asking rent growth remained nearly flat quarter-over-quarter, increasing slightly by less than 1.0% to $8.78 per sq. ft. NNN.

- Availability rates in metro Denver saw a marginal increase of 30 bps to 7.9%, while vacancy rates remained flat at 6.7%.

- As economic uncertainty continues and capital markets remain volatile, sales activity once again fell in Q2 2023, recording an overall volume of $98.0 million.