According to CBRE’s Colorado Springs Retail MarketView, for the first time in over 10 years, the Colorado Springs retail market posted negative net absorption. Through the first half of 2020, 282,000 square feet of negative net absorption was recorded.

- Direct vacancy increased to 6.1% in Q2 2020, up 107 bps from Q4 2019.

- Construction activity remained active with nearly 412,000 sq. ft. of retail space under development at the end of Q2 2020.

- The average asking lease rate has been stable since Q4 2018, sitting at $14.33 per sq. ft. triple net (NNN) in H1 2020.Year-to-date investment sales declined by 33.6% year-over-year, recording $61.6 million in sales volume. Single tenant net leased properties accounted for a large share of the sales volume so far this year, pushing up the average price per sq. ft. to $316.

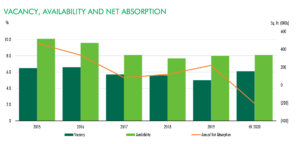

Vacancy, Availability and Net Absorption

- Annualized net absorption through Q2 2020 was negative 205,000 sq. ft. This is a drastic change from the previous five years when annual net absorption averaged positive 244,000 sq. ft.

- Eight of the 12 submarkets posted negative net absorption in H1 2020 with the Northeast submarket recording the largest negative net absorption of 137,000 sq. ft.

- Total availability remained relatively stable at 8.1% in Q2 2020.

Net Absorption and Construction

- Four new retail properties—all located in the Northeast submarket—delivered in H1 2020, totaling 42,000 sq. ft.

- Nearly 412,000 sq. ft. was under construction at the end of Q2 2020. Over 67% of the retail space underway is located in the Northeast submarket.

- The largest project under development is the 220,000-sq.-ft. Scheels sporting goods store at InterQuest Marketplace in the Northeast submarket and scheduled to open in April 2021.