The construction market continued to experience significant inflationary challenges in early 2022, according to Mortenson’s Cost Index. Optimism for moderating costs in the latter half of the year has lessened and will be dependent on a variety of external factors including global stability, supply chain continuity, labor markets, and general economic conditions in the U.S.

In Denver, the data collected for the Mortenson Cost Index is showing an increase of 2.3% nationally and 3.2% in Denver for the first quarter of 2022. Over the last twelve months, costs increased 18.3% nationally and 20.3% in Denver.

Construction Employment

The Bureau of Labor Statistics data confirms that construction job openings outpaced hires and set a record high for February, the latest month data is available. Building construction employment in the Denver metro region reached 18,600 in March 2022. This is a 2% increase (400 jobs) compared to March 2021. Labor availability will remain a top concern throughout 2022.

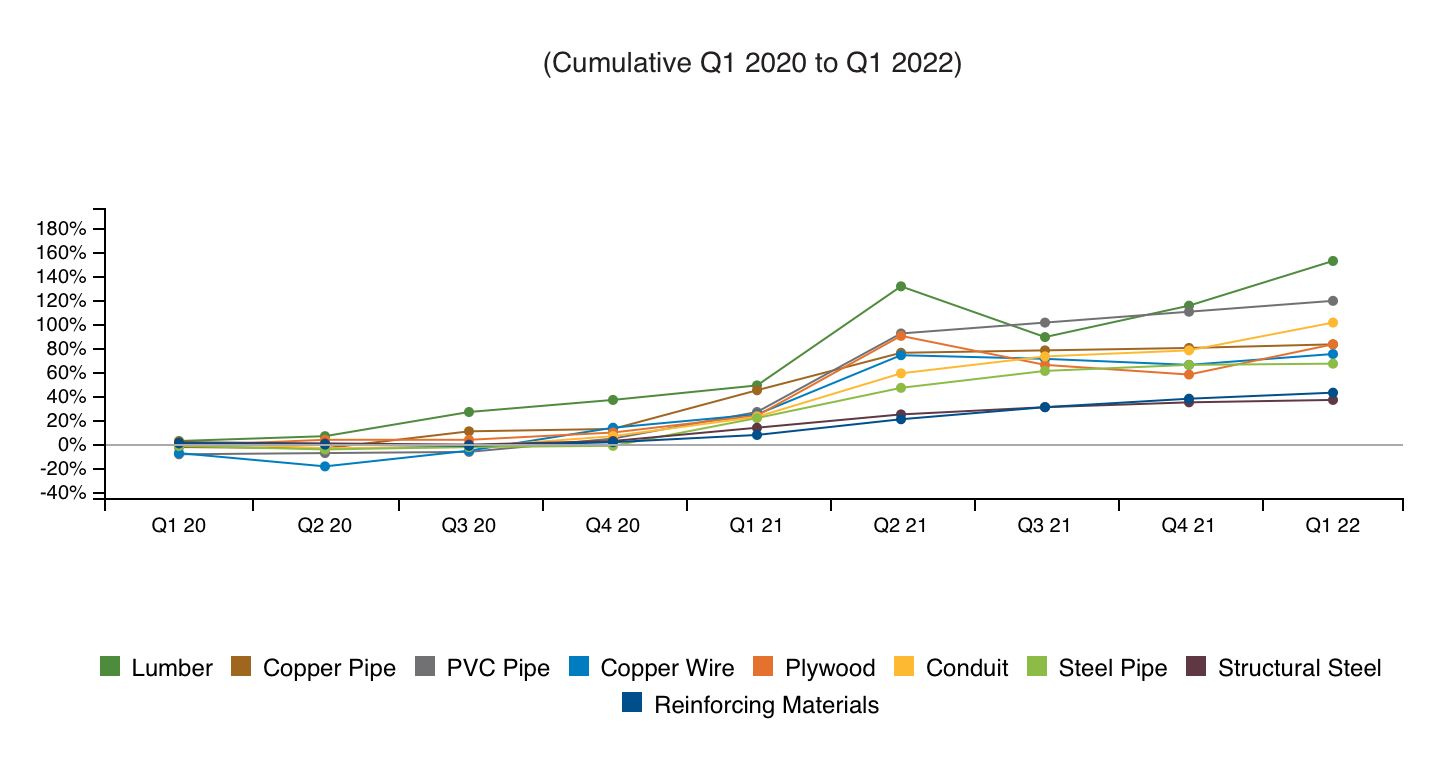

Costs for building materials remain escalated due to manufacturing issues, supply chain delays, rising fuel costs, and the Russian invasion of Ukraine.

While construction spending remains robust, fast-changing materials pricing, product lead times, fuel price increases, and labor availability and costs continue to strain suppliers, contractors, and projects. No one industry or building type has been exempt from the ongoing market challenges although pandemic-delayed projects and owners across many different project types continue to move forward in the face of ongoing market conditions.

Based on factors affecting the industry, the Associated General Contractors of America (AGC) has updated their construction inflation alert for this year, indicating the market is still far from what it deems “normal.” According to the AGC, the Russian invasion of Ukraine and responding world sanctions on Russia are driving additional price increases and supply-chain disruptions that show little signs of abatement. The AGC says that costs and labor availability will remain a top concern throughout 2022.

The Mortenson Construction Cost Index data reflects current market conditions with increases in all 30 component categories tracked, which includes labor, material, equipment, and trade partner feedback. For the first quarter of 2022, construction cost data is signaling an average input cost increase of 2.3%. Our national construction cost data is signaling an average input cost increase of 2.3% for the first quarter of 2022 and 18.3% over the last twelve months.

Based on AGC data and observations and our insights, Mortenson sees persistent cost fluctuations, supply-chain disruptions and workforce shortages continuing in the near term. A resilient approach working to respond to and minimize these ongoing impacts during project planning and execution will continue to be paramount over the coming months.

Download the full report HERE