DENVER – Retailers this holiday season will double down on strategies to draw online shoppers into stores, reward their loyalty in new ways and ensure that toys are available at every turn, according to a new report from CBRE.

CBRE’s annual Holiday Retail Trends Guide found a common theme connecting several of the strategies prepared by retailers for this season: Enhanced capabilities to seamlessly cater to shoppers in stores, online and on their mobile devices.

CBRE’s annual Holiday Retail Trends Guide found a common theme connecting several of the strategies prepared by retailers for this season: Enhanced capabilities to seamlessly cater to shoppers in stores, online and on their mobile devices.

“From our local Denver mom-and-pops to the major global chains, retailers are trying new ways to remain relevant and make the retail experience more engaging, convenient, and unique. While online shopping is a great option for the consumer prioritizing convenience, there’s an irreplaceable nostalgia associated with visiting a physical store all decked out for the holidays. Denver’s retail market is poised to fare well this holiday season as low unemployment and a strong local economy tend to translate to disposable income that can be directed toward those holiday gift purchases and experiences,” said Michael Kendall, vice president, CBRE.

CBRE outlines four trends shaping this season:

The Optimistic Shopper

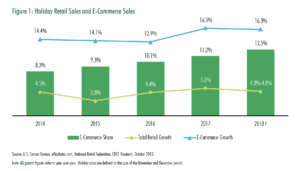

The strong economy and near-full employment helped push retail sales growth to a six-year high in this year’s first half, which in turn has generated forecasts of healthy retail-sales gains of up to 4.8 percent for the holiday season. Retailers excelling in this environment mostly are those so proficient at selling across multiple channels that few of their transactions are strictly in-store or online anymore.

Buy-Online/Ship-To-Store (BOSS)

For several years, retailers have promoted their buy-online/pickup-in-store programs, which focus on merchandise already stocked at the store level. This season, the latest

evolution of that strategy – buy-online/ship-to-store, or BOSS – allows shoppers to select from a wider inventory of merchandise stocked at the retailers’ warehouse to be delivered to their nearest store. Retailers including Macy’s Inc. and Kohl’s Corp. are betting that BOSS will both cut their delivery costs and generate add-on sales to shoppers who visit stores to pick up their orders. Key to BOSS’ success will be the incentives retailers offer shoppers to use it.

Experience The Rewards Of Loyalty

Retailers are enhancing their loyalty programs to retain shoppers, and their sweeteners of choice are experiences and access. Retailers including Macy’s, Sephora, Nordstrom Inc., Target and L Brands’ Victoria’s Secret have upgraded their loyalty programs this year to reward shoppers with perks such as access to exclusive events like fashion shows. In Sephora’s case, that includes meetings with its founders. The trend underscores retailers’ efforts to build stronger connections between their shoppers and their brands.

Toys “R” All Of Us

The closure this year of Toys “R” Us’ stores cleared the way for a wave of opportunistic retailers to fill the void. Several leading retailers such as Walmart and Target are expanding their toy sections. Meanwhile, others that aren’t widely known as toy sellers, including Michaels, Party City and Ace Hardware, are jumping in with limited toy offerings. At stake are $1.3 billion in sales in the fast-growing toy category. “This looks to be a strong holiday season for retail for several reasons,” said Brandon Famous, Chairman of CBRE’s Global Retail Occupier Executive Committee. “In addition to the tailwinds of the robust economy and strong consumer confidence, retailers as a whole have gotten smarter and more efficient with their omnichannel strategies and their programs for attracting and retaining customers.”