CommercialEdge just released its June U.S. office market report examining current market conditions, including the challenges tech markets face due to remote and hybrid work models. The cities with higher percentages of remote workers have seen significant increases in vacancy rates, and distress is expected to increase.

Key findings from the report:

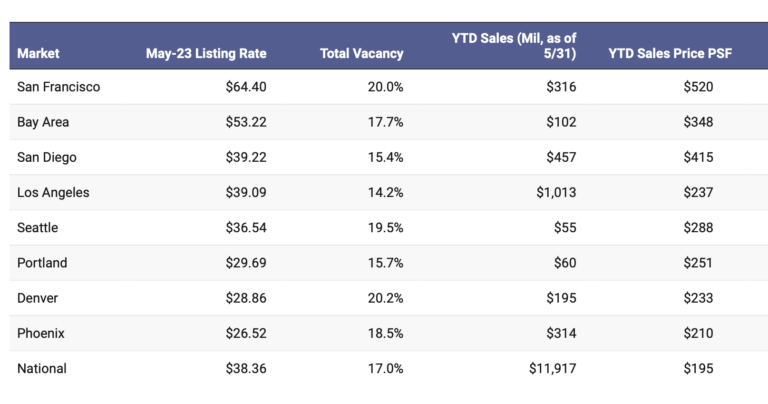

- The average U.S. office listing rate stood at $38.36/sq. ft., rising 2.1% Y-o-Y

- Up 30 basis points Y-o-Y, the national vacancy rate was 17%

- Under-construction office space reached 116.2M sq. ft. nationwide, accounting for 1.8% of total stock

- Office sales amounted to $11.9B in May, with assets trading at $195/sq.ft.

- Los Angeles sale prices fell 43% compared to last year, to $237/sq. ft.

- Chicago claimed the sixth-highest sales volume nationwide, with $588M in closed deals

- With properties trading at $356/sq. ft., Austin recorded the highest average sale price in the South

- New Jersey boasted the second-largest sales volume in the North, totaling $827M

Overall, all leading Western markets saw increases in vacancy rates over the past 12 months. However, markets driven by the life sciences sector generally recorded higher occupancy rates. At the end of May, the Bay Area had 17.71% of its total office space available for lease; meanwhile, San Diego’s vacancy rate stood at 15.36%, below the 17.05% national rate.

The life sciences sector also kept asking rates higher in San Diego, with rents reaching $47.83 per square foot at the end of May. Nationally, the metro’s lease rate was only outpaced by the Bay Area’s asking rent of $54.02 per square foot, San Francisco’s $65.98 per square foot, and Manhattan’s $73.57 per square foot. The lowest asking rents in the West were recorded in Phoenix ($27.53 per square foot), Portland ($28.63 per square foot), and Denver ($30.47 per square foot).

To read the full report CLICK HERE.