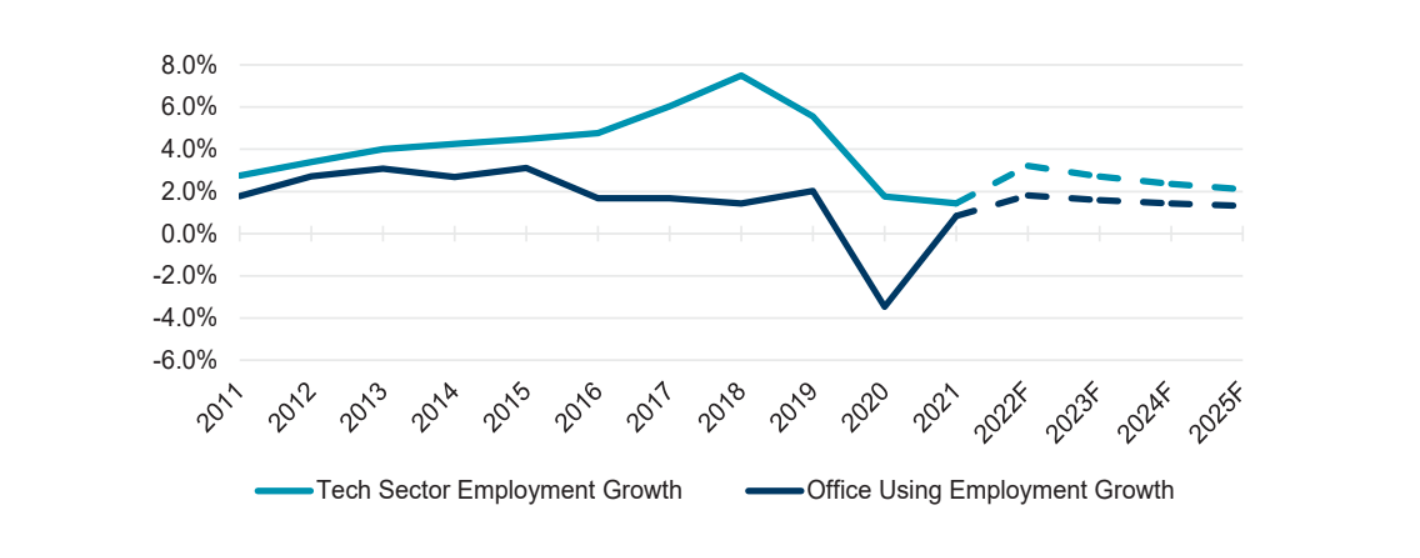

According to a new Cushman & Wakefield tech-focused report entitled: Denver Tech Sector – A Growth Story in Denver’s Still Recovering Office Market, tech sector employment growth is forecasted to outpace office using employment growth by an average of 110 basis points annually through 2025.

Report Highlights:

- The Covid-19 pandemic caused more talent to disperse into secondary markets, with talent and tech companies alike gravitating toward cities like Denver for its affordability, high quality of life and highly educated workforce.

- Denver ranks fifth nationally among the most educated metro areas, with nearly 45% of the over 25 population having a bachelor’s degree or higher. Approximately 46% of Denver’s working-age population (ages 20-69) is between the ages of 20 to 39.

- Denver’s tech sector was one of the few sectors to actually post a net gain in jobs during the pandemic. Tech sector employment rose 3.2% from 2019 to 2021, while office using employment recorded a 2.7% decrease over the same period.

- These employment gains have translated into a higher proportion of office leasing activity compared to other industries. In 2021, the sector accounted for approximately 20.2% of leasing activity, well above its recent five-year average of 16.7%.

- Flight-to-quality amongst tech firms has been a consistent theme in Denver, with more than 75% of activity occurring in Class A buildings and new construction as companies position themselves to better recruit and retain top talent.

Read download the full report, click here.