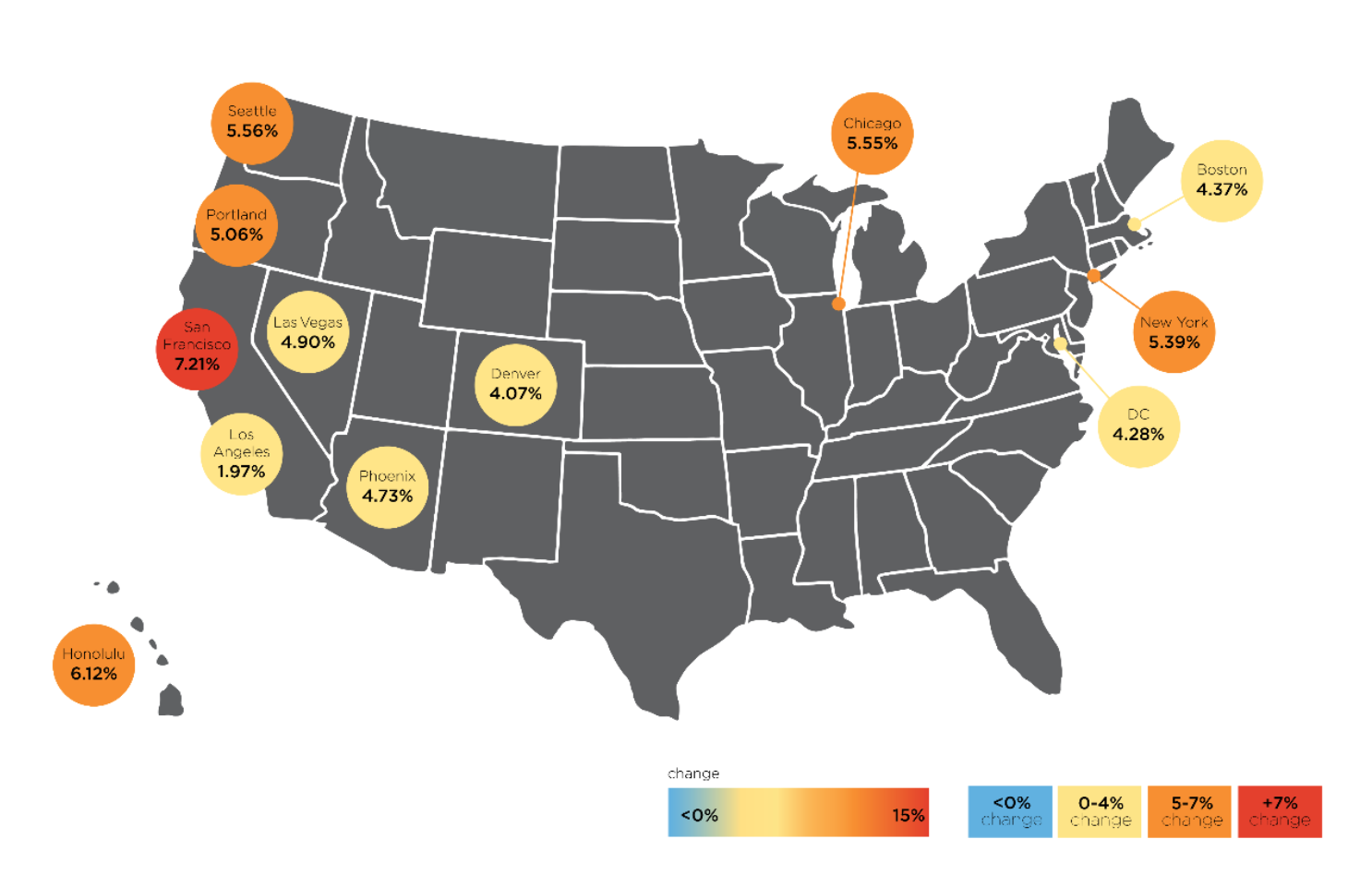

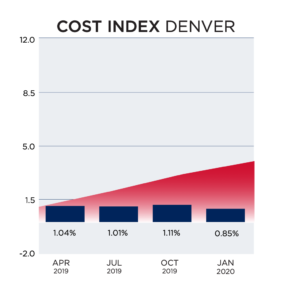

Chicago, Honolulu, New York, Portland, San Francisco, and Seattle experienced the greatest annual increases, showing escalation above the national average. Boston, Denver, Los Angeles, Phoenix, and Washington, D.C. all experienced lower annual increases, ranging from 1.97% (Los Angeles) to 4.90% (Las Vegas).

According to the U.S. Department of Commerce, construction-put-in-place during January 2020 was estimated at a seasonally adjusted annual rate of $1,369.2 billion, which is 1.8 percent the revised December 2019 estimate of $1,345.5 billion, and 6.8 percent above the January 2019 estimate of $1,282.5 billion.

Each quarter, Rider lever Bucknall looks at the comparative cost of construction in 12 U.S. cities, indexing them to show how costs are changing in each city in particular, and against the costs in the other 11 locations. It is important to note, however, this data is only current to January 1, 2020 and does not indicate effects of the COVID-19 pandemic.

Comparative Cost Index tracks the ‘true’ bid cost of construction, which includes, in addition to costs of labor and materials, general contractor and sub-contractor overhead costs and fees (profit). The index also includes applicable sales/use taxes that ‘standard’ construction contracts attract. In a ‘boom,’ construction costs typically increase more rapidly than the net cost of labor and materials. This happens as the overhead levels and profit margins are increased in response to the increasing demand. Similarly, in a ‘bust’, construction cost increases are dampened (or may even be reversed) due to reductions in overheads and profit margins.

“It’s not the shutdowns themselves that will transform the construction industry; rather, the changes will stem more from the effects of the recession that will follow the closures,” says Julian Anderson FRICS president, North America. ” One example of this centers on the supply chain of construction goods and equipment. Currently, Chinese factories are beginning to resume production, but it’s going to be some time before they reach full capacity. Meanwhile, inventories already on-shore do seem to be sufficient to keep some small projects going. Looking ahead, architects and contractors will try to diversify their materials sources—specifically, beyond China—to provide more options in case of future major disruptions in the supply chain.”

To download the full report click here.