Cushman & Wakefield has published a new report Infrastructure Investment And Jobs Act: Why It Matters for Commercial Real Estate.

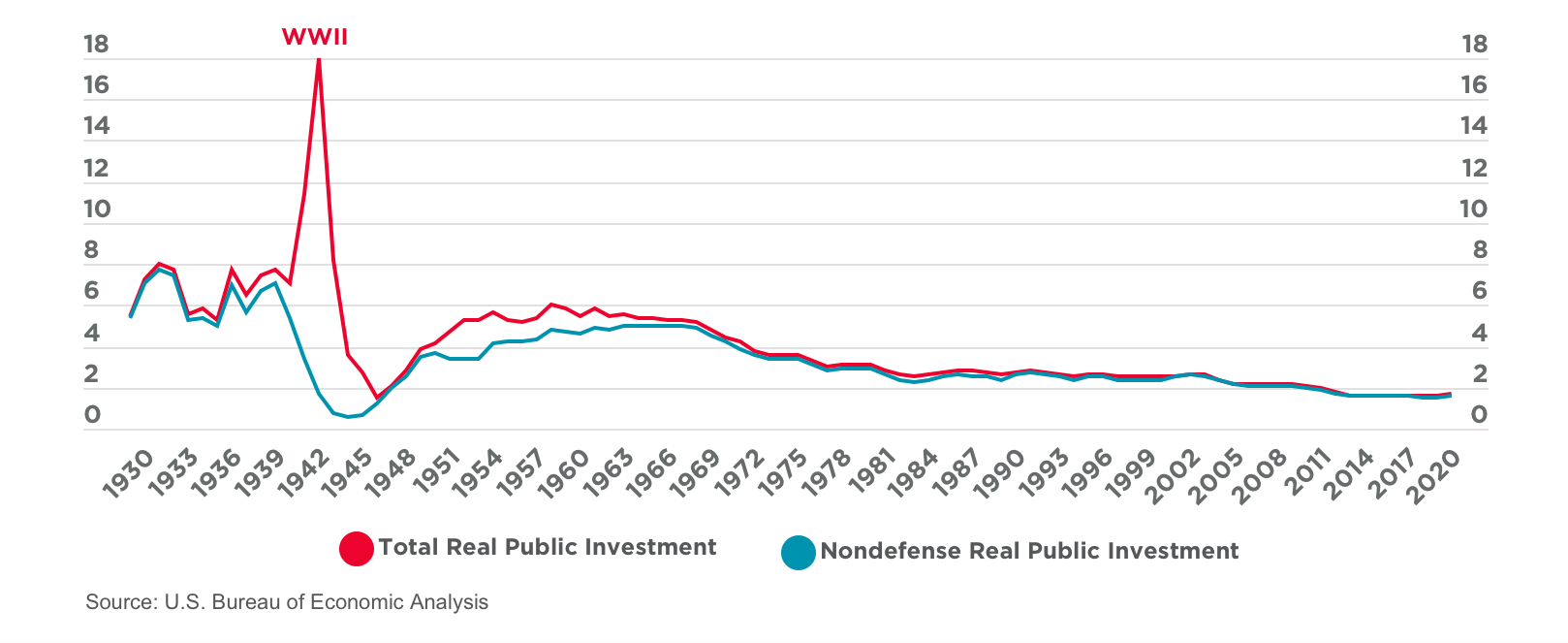

On November 15, President Biden signed the bipartisan Infrastructure Investment and Jobs Act (IIJA) into law. Carved out of the more aggressive Build Back Better vision, it marks one of the most significant investments in physical infrastructure in the U.S. in at least half a century. In this report, Cushman & Wakefield gives a quick take on the following:

- The infrastructure bill and what’s significant about it

- Which regions will benefit the most from it

- How it will impact the U.S. economy and property markets

Key takeaways:

- It is estimated that the infrastructure bill will raise GDP growth by a cumulative 3.5% from 2022-2031, and long-term GDP growth by 0.1% per annum.

- The IIJA is not expected to place any material pressure on near-term inflation as the money takes time to get dispersed, and it could result in downward pressure on prices longer-term through expected efficiency and productivity gains.

- Industrial is the biggest winner, but all property types stand to benefit.

- As a result of the infrastructure bill, we estimate that the total demand for commercial real estate space will be 1.2% higher over the next five years.

What is the infrastructure bill?

The IIJA is a $1.2 trillion infrastructure package that has two key components. The first is the reauthorization of $650 billion of prior mandatory funding that would have occurred under current law. This is spending from various trust funds that is automatically raised and already allocated to pre-existing programs. For example, surface transportation programs under the Highway Trust Fund. Funding is also pre-determined for these programs. Examples include excise taxes on the sale of motor fuel, trucks and trailers and truck tires.

The second component is the additional $550 billion in funding for new investments in infrastructure.1 These range from significant increases in funding for highways and roads to the electric grid, passenger rail, broadband, water infrastructure, environmental resilience and remediation, public transit, waterways, ports, airports and other investments.

To read the full report, click here.