DENVER — CBRE just-released Q3 reports for metro Denver’s office, industrial and retail sectors.

Denver Office, Q3 2017: New deliveries spark record high lease rates

The Denver office market reached new heights in Q3 2017 as direct average asking lease rates climbed 3.0% year-over-year to $26.38 per sq. ft. full service gross (FSG), a record high. Direct vacancy tightened 25 basis points (bps) quarter-over-quarter to 12.6%. Strong positive net absorption of 933,139 sq. ft. was recorded in the quarter, which was driven by the occupancy of newly delivered Class A space. Sublease availability ended the quarter at 2.7 million sq. ft. with 25.1% located in Southeast Class A spaces and 24.7% located in Downtown Class B spaces.

The Denver office market reached new heights in Q3 2017 as direct average asking lease rates climbed 3.0% year-over-year to $26.38 per sq. ft. full service gross (FSG), a record high. Direct vacancy tightened 25 basis points (bps) quarter-over-quarter to 12.6%. Strong positive net absorption of 933,139 sq. ft. was recorded in the quarter, which was driven by the occupancy of newly delivered Class A space. Sublease availability ended the quarter at 2.7 million sq. ft. with 25.1% located in Southeast Class A spaces and 24.7% located in Downtown Class B spaces.

Total construction activity neared 4.4 million sq. ft., featuring Downtown’s 1144 Fifteenth (671,101 sq. ft.) and the Southeast’s Village Center Station II (306,000 sq. ft.). Investment sales volume exceeded $207.8 million and was supported by sustained suburban activity.

- The average direct asking lease rate

reached a record high of $26.38 per sq.

ft. FSG, a 3.0% increase year-over-year. - Direct vacancy decreased to 12.6%, 292

bps below the cycle high of 15.5% in Q2

2011. - Notable lease transactions in the quarter

included 246,500 sq. ft. at One Belleview

Station to Western Union, 141,736 sq. ft.

at INOVA II Dry Creek to The Travelers

Company and 48,445 sq. ft. at 2675

Crescent Drive in Lafayette to Ball

Aerospace. - Rees Properties’ acquisition of 8181 E

Tufts Avenue in the Denver Tech Center

for $40.0 million, or $215.92 per sq. ft.,

was the largest single-building

transaction of the quarter.

Denver Industrial, Q3 2017: Highest positive net absorption ever recorded

Metro Denver continued its positive net absorption streak for a 30th consecutive quarter, with 1.9 million sq. ft. of positive net absorption. This was the highest quarterly net absorption ever recorded in metro Denver history. Average asking lease rates decreased slightly to $7.61 per sq. ft. triple net (NNN), down two cents from the previous quarter. Vacancy rates decreased to 5.4% while availability dropped 20 basis points (bps) to 8.1%.

Metro Denver continued its positive net absorption streak for a 30th consecutive quarter, with 1.9 million sq. ft. of positive net absorption. This was the highest quarterly net absorption ever recorded in metro Denver history. Average asking lease rates decreased slightly to $7.61 per sq. ft. triple net (NNN), down two cents from the previous quarter. Vacancy rates decreased to 5.4% while availability dropped 20 basis points (bps) to 8.1%.

Construction deliveries were the driving force behind absorption with 1.6 million sq. ft. delivering this quarter and another 4.4 million sq. ft. currently under construction.

Speculative (spec) builds accounted for 67.1% of the total space under construction. Total investment and owner/user sales value were $255.1 million this quarter.

- Positive net absorption of 1.9 million sq. ft.

occurred this quarter–driven by new

deliveries. - The direct vacancy rate remained low at

5.4%, down 10 bps quarter-over-quarter.

The overall average asking lease rate was

$7.61 per sq. ft. NNN in Q3 2017, down

slightly from the previous quarter. - Projects under construction totaled 4.4

million sq. ft. with 1.6 million delivering

Q3 2017.

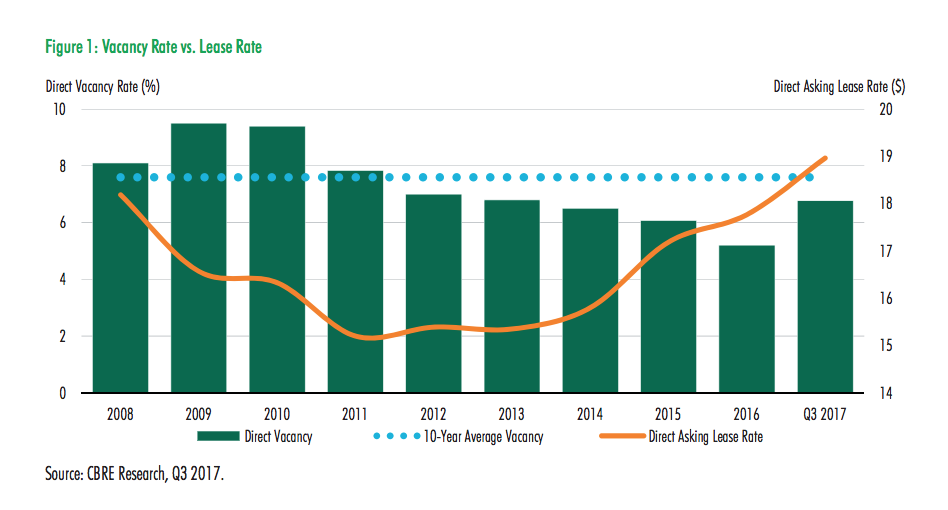

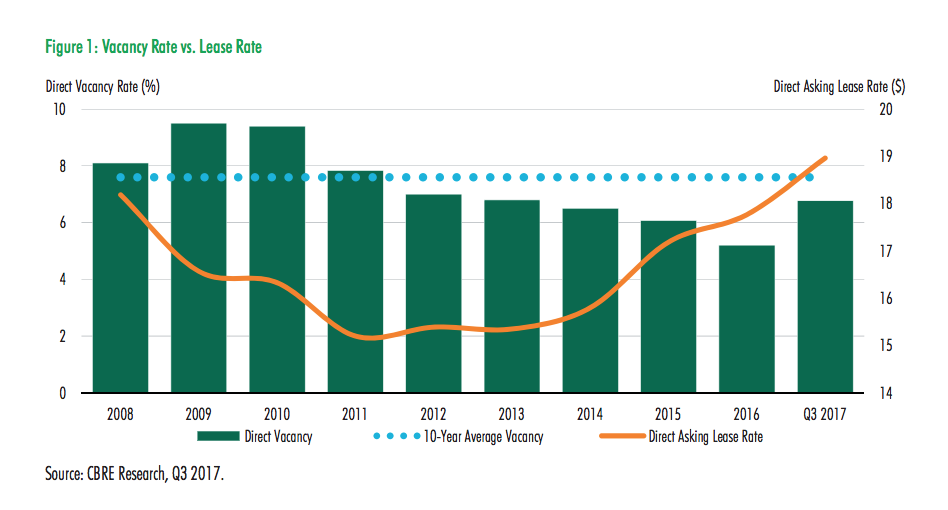

Denver Retail, Q3 2017: Rising lease rates indicate tight Class A market

Negative net absorption of 41,759 sq. ft. was recorded in Q3 2017, bringing year-to-date net absorption to negative 36,497 sq. ft. Consistent leasing activity from fitness, fast casual restaurants, grocery and entertainment venues continued to offset big box closures, resulting in the moderate losses in net absorption this year.

Negative net absorption of 41,759 sq. ft. was recorded in Q3 2017, bringing year-to-date net absorption to negative 36,497 sq. ft. Consistent leasing activity from fitness, fast casual restaurants, grocery and entertainment venues continued to offset big box closures, resulting in the moderate losses in net absorption this year.

The average direct asking lease rate rose to $18.97 per sq. ft. triple net (NNN), a 4.4% increase over last quarter and an 11.3% increase year-over-year. Direct vacancy increased by 57 basis points (bps) quarter-over-quarter to 6.8% and availability rose by 40 bps to 9.1%.

Development remains strong with nearly 1.4 million sq. ft. still under construction and 350,000 sq. ft. delivering in the quarter. Investment activity picked up in Q3 2017, reaching $291.7 million in sales volume with 19 properties priced above $3.0 million trading hands.

- The average direct asking lease rate

increased to $18.97 per sq. ft. NNN in Q3

2017, up 4.4% from the previous quarter. - Negative net absorption of 41,759 sq. ft. was

recorded in Q3 2017, bringing year-to-date

net absorption to negative 36,497 sq. ft. - Nearly 1.4 million sq. ft. was under

construction and 350,000 sq. ft. of retail

space delivered in Q3 2017. - Total sale transaction volume in Q3 2017

totaled $291.7 million, up 62.0%

year-over-year.