By Katie Rapone, editor

On Friday May 7, ABC Rocky Mountain Chapter held its in-person/virtual 2021 Economic Forecast with Dr. Basu, MPP, MA, JD, Ph.D., ABC’s chief economist. Dr Basu shared his insight on how the economy has and will impact Colorado’s construction industry, including his forecast for the remainder of the year.

The presentation, tailored to Colorado, provided economic data and analysis juxtaposing the pre-pandemic and pandemic world, and then supplied a forecast for the post-pandemic one. Among the areas of focus were labor markets, financial markets, real estate, construction, consumer spending, business investment, international trade and government finances.

According to Basu, in 2020 the U.S. economy shrank 3.5 percent and in April lost 20.7 million jobs. “If you do the math on that, between March and April of last year, we lost as many jobs as we added in the previous 113 months—that information is jarring and has got to have implications for the construction economy,” said Basu.

Unlike during the 2008 recession, which Basu describes as a “demand shock,” the coronavirus pandemic caused a “supply shock,” which is why this time around, the economy has largely experienced a V shaped recovery. As a whole, Dr. Basu expects the back half of 2021 to be “spectacular for economic growth.”

Key Pandemic Takeaways

- Colorado Construction lost 6,800 jobs between February 2020 and March 2021.

- Leisure and Hospitality sector performed the worst losing 70,700 jobs.

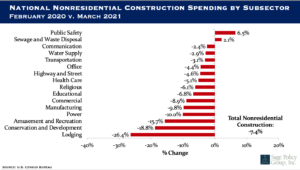

- Architects were less “busy” during the pandemic due to the decreased demand for new CRE construction.

- Home price appreciation soared during the pandemic and interest rates decreased.

- The value of proximity declined in the U.S. as more people moved away from the city to the suburbs.

- Rents declined in urban areas and increased in the suburbs.

- Despite many retail bankruptcies, retail sales recovered quickly in May 2020 thanks to e-commerce.

Crystal Ball Takeaways

- The commercial real estate industry will be among the last sectors, from a real estate perspective, to fully recover.

- New office and hotel are not likely to be active markets for the next few years.

- Class B and C office buildings will likely be renovated to attract Class A office tenants on the move.

- Adaptive reuse of retail buildings will be big business for contractors going forward.

- The apartment construction boom is over with respect to principal cities. That market will remain weak for some time.

- Construction backlog as of April 2021 is back to pre pandemic levels at 7.9 months.

- Despite labor shortages and material prices skyrocketing, the construction industry remains very optimistic that profit margins will increase in the next six months.

Economic Outlook

- For an economy to flourish, both demand and supply sides of economy must participate.

- With ongoing stimulus, demand gets a further boost, but supply will be constrained by numerous factors, and not just in America.

- The result is that the U.S. savings rate will remain elevated, spring loading the economy for rapid economic growth once vaccines become more broadly available.

- The back half of 2021 should be spectacular for economic growth.

- However, there will be a day of reckoning as deficit hawks come back into fashion, creating the possibility of greater austerity during the years ahead.