Adding to its Q2 reports on the office and industrial property sectors, CBRE has released more insight into the Metro Denver office, industrial, and retail sectors. Retail availability continues to tighten as tenant demand remains robust, while medical office vacancy rates reached a new low, underscoring sustained demand in the MOB Market.

Q2 2023 Metro Denver Retail Highlights

- Nearly 145,000 sq. ft. of net absorption was recorded in Q2 2023, the ninth consecutive quarter of positive net absorption.

- Direct vacancy increased 10 basis points (bps) quarter-over-quarter to 6.2%, while availability dropped 10 bps to 6.2%.

- The average asking rent remained the same at $19.77 per sq. ft. NNN quarter-over-quarter.

- The construction pipeline exceeded 410,000 sq. ft. in Q2 2023. Six projects totaling just over 233,000 sq. ft. delivered in the second quarter showing an 18.1% increase quarter-over-quarter.

- Sales volume totaled $153.4 million in the second quarter, a moderate 8.1% quarter-over-quarter decrease.

Q2 2023 Downtown Denver Office Highlights

- Negative 25,000 sq. ft. of direct net absorption was recorded in Q2 2023, up from negative 150,400 sq. ft. last quarter and negative 241,000 sq. ft. in Q2 2022.

- After peaking at 2.3 million sq. ft. last quarter, sublease volume decreased 2.3% quarter-over-quarter to 2.2 million sq. ft.

- Leasing activity totaled 405,400 sq. ft., a notable improvement from the 177,600 sq. ft. transacted in the prior quarter and up 2.0% year-over-year.

- The average direct asking rent rose 0.4% to $39.60 per sq. ft. FSG, which reflects a decrease of 1.4% year-over-year.

- Total vacancy decreased 30 basis points (bps) quarter-over-quarter to 28.8% in Q2 2023, marking the first quarter of decreasing vacancy since 2019. Direct vacancy increased 10 bps quarter-over-quarter and 80 bps year-over-year to 24.4%.

- 1900 Lawrence remains the sole property under construction, keeping the development pipeline static at 704,000 sq. ft.

Q2 2023 Southeast Denver Office Highlights

- Negative 152,000 sq. ft. of direct net absorption was posted in Q2 2023, ending the trend of positive absorption seen in the last two quarters.

- No new office projects broke ground this quarter, as developers decline to take the bet of speculative office and anchor tenants for a project remain scarce.

- Leasing activity decreased 18.7% quarter-over-quarter to 317,000 sq. ft., with one renewal accounting for 68.1% of total activity.

- Sublease availability declined 10.9% quarter-over-quarter to 1.9 million sq. ft., as no large blocks of additional space hit the market.

- Total vacancy increased 30 bps quarter-over-quarter to 18.8%, while direct vacancy rose 40 bps to 16.0%.

- The average direct asking rent continued to remain stable, decreasing marginally quarter-over-quarter to $27.91 per sq. ft. FSG.

H1 2023 Metro Denver Medical Office Highlights

- Metro Denver’s medical office building (MOB) market posted 125,500 sq. ft. of positive net absorption in H1 2023, a slight decrease from the 228,600 sq. ft. recorded at the end of 2022.

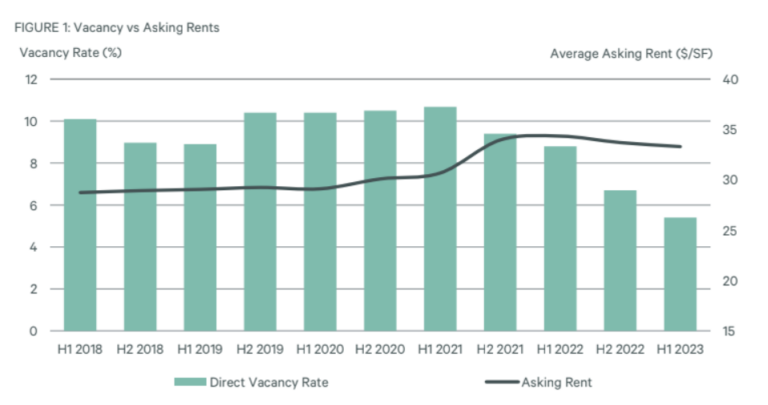

- Direct vacancy reached a record low, decreasing 140 basis points (bps) year-over-year to 5.6% in H1 2023.

- The construction pipeline remained below historical levels but saw an uptick in activity with two properties totaling 217,700 sq. ft. breaking ground. 8900 46th Plaza was the sole property that was delivered in H1 2023.

- 10 properties traded hands in the first half of 2023 for a total sales volume of $66.3 million ($291.58 per sq. ft.), a decrease of 54.8% year-over-year.

- After reaching a record high in 2021, the average direct asking rent has begun to level out, decreasing 1.7% year-over-year to $33.30 per sq. ft. FSG. Off-Campus lease rates drove the annual dip, decreasing 3.1% year-over-year to $30.44 per sq. ft.