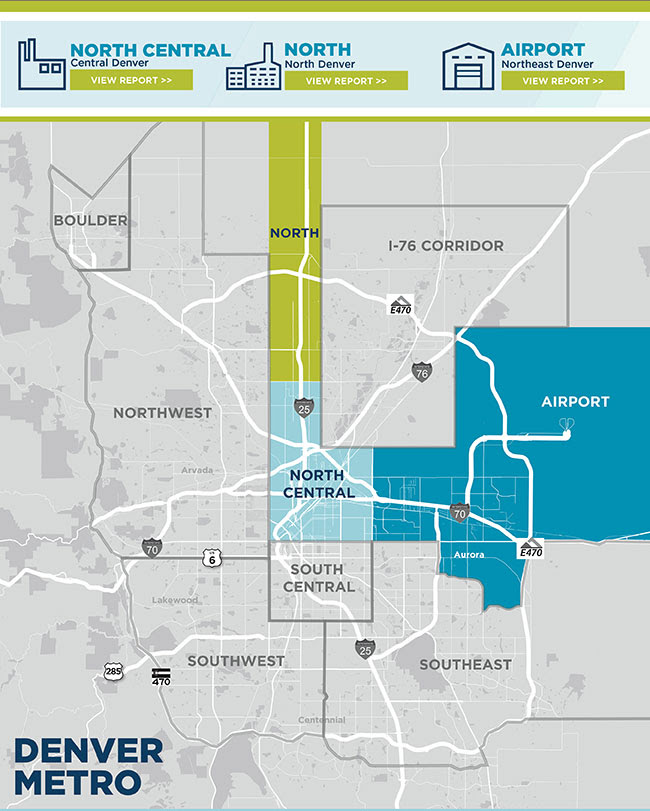

Cushman & Wakefield has released its Q3 report for Denver’s industrial market which names the three most active industrial submarkets. These are North Central, North Denver, and the Airport/Northeast Denver.

ACTIVITY: Leasing Activity Experiences Decline After Strong Q2 2023

After a robust leasing performance in the second quarter 2023, the third quarter was relatively subdued in terms of leasing activity, with just under 1.5 msf in recorded transactions. This brought the YTD leasing activity total to approximately 8.5 msf, trailing the 2022 YTD over the same period by 15.2%. However, activity remains elevated compared to pre-pandemic levels, with the 2023 YTD leasing activity outperforming the first three quarters of 2019 by nearly 6.5%.

ABSORPTION: Relocations Cut into Net Absorption Total

Similar to leasing activity, overall net absorption totaled just under 600,000 sf in the third quarter 2023, a decline of nearly 145.0% compared to the second quarter. Though the third quarter marked several highly-anticipated move-ins, 0.5 the tenants’ subsequent disposition of their previous space resulted in lower net absorption, a factor which no doubt affected the third quarter total. Though 2021 and 2022 recorded significantly higher absorption totals due to robust build- -0.5 to-suit (BTS) activity, 2023 YTD is outpacing both 2020 and 2019 through the first three quarters. Furthermore, with several large BTS projects on track to deliver in the fourth quarter, 2023 year-end net absorption is poised to exceed 4.0 msf for the third consecutive year.

CONSTRUCTION: With 825KSF in New Construction Starts, the Pipeline Swells to 9.0 MSF

Seven buildings totaling just over 1.2 msf delivered in the third quarter 2023, bringing the YTD completion sum for industrial product to approximately 4.1 msf. However, after only 289,000 sf of new construction starts in the second quarter, nearly 825,000 sf broke ground in the third quarter 2023, bringing the under-construction figure to just over 9.0 msf. Though the increased cost of debt continues to be a roadblock for new development, there are several capitalized projects slated to break ground before the end of 2023, indicating that while the construction boom in Denver is likely on the decline, it has yet to fully come to an end. Built-to-suit activity continues to be steady in Denver, with five projects (3.5 msf) currently under construction and two additional projects, estimated to total 1.2 msf, expected to break ground within the next twelve months.

SALES: Investment Volume Increases While Remaining Subdued

Despite continued headwinds, the third quarter 2023 recorded $120.6 million in investment volume, a 15.5% increase in sales activity QOQ. Prior to the interest rate hikes in mid-2022, investment activity was focused on new construction product in Denver. However, the focus has now shifted to value-add second-generation space with shorter WALT in strategic infill locations. That being said, the largest transaction of the quarter was the sale of Dove Valley Business I, a 149,600-sf Class A warehouse facility that was built in 2018. Westcore purchased the building from Haleakal Ranch Company for $29.7 million, or $198 psf. The building was fully leased at the time of the sale.

OUTLOOK:

• While sublease space accounts of less than 1.0% of the total market inventory, sublease availability has increased by 45.2% since the beginning of 2022, While this trend remains niche for now, the rise in sublease availability could foreshadow a decrease in demand in future quarters.

• Though several fully-capitalized speculative projects remain in the pipeline, construction activity is expected to slow over the next couple years as the market works to absorb the current product which remains vacant.

• With the rising cost of capital is affecting how both lenders and investors underwrite buildings, the investment focus has shifted from new product to stabilized product, with investors concentrated on fully-leased buildings.

CLICK HERE to download the full report.