With headlines of bankruptcy, job cuts and continued low oil prices, the decline of oil and gas companies in Colorado is spilling over into the commercial real estate market. This resulting abundance of office sublease space, allowing new tenants such as co-working companies to occupy the CBD, has the potential to alter the office real estate culture in downtown Denver.

by Julie Wanzer, LEED AP

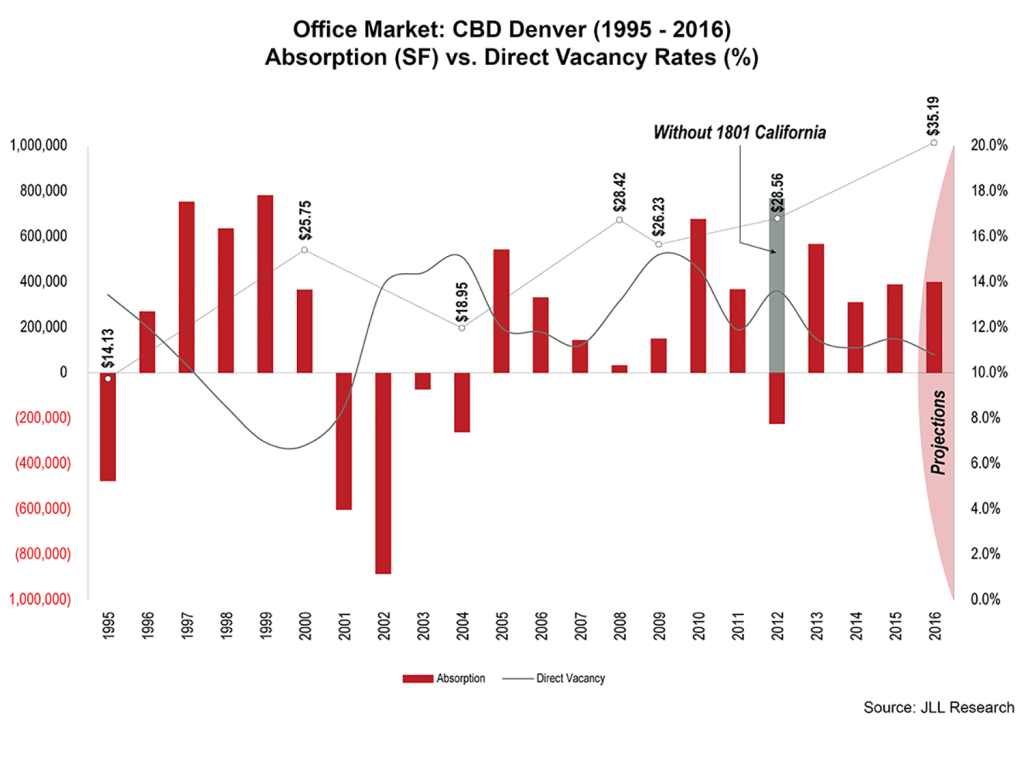

The first quarter of 2016 ended with a rise in office vacancy rates, especially in in the Central Business District (CBD) of Denver where total availability exceeds 19%, according to JLL’s Office Insight research report. This number includes non-vacant spaces and a large number of oil and gas subleases that are currently available. In regards to the sublease market in CBD, JLL’s Senior Research Manager for Denver, Thomas Jaroszewski comments, “Vacancy rates, for the most part, will remain steady on a direct basis, but the rise comes in when considering the energy-company sublease space coming to market. Beginning in 2015, there was just under 845,000 SF brought back to the sublease market and currently about 593,000 SF still available.”

As traditional oil and gas companies vacate the existing office spaces in downtown Denver, the question remains as to who will fill these spaces and absorb this negative net absorption of 349,535 SF in the first quarter as reported by JLL. Mr. Jaroszewski attributed a migration of new tenants that want to occupy office space in the CBD that was not historically available, as one of the foreseeable effects of the continued decline of the oil and gas industry.

traditional oil and gas companies vacate the existing office spaces in downtown Denver, the question remains as to who will fill these spaces and absorb this negative net absorption of 349,535 SF in the first quarter as reported by JLL. Mr. Jaroszewski attributed a migration of new tenants that want to occupy office space in the CBD that was not historically available, as one of the foreseeable effects of the continued decline of the oil and gas industry.

One source of viable tenants includes the wave of co-working spaces companies that are taking over offices and industrial warehouses, and remodeling them to accommodate the influx of entrepreneurs in Colorado. The 2015 Kauffman Index report, which tracks startup activity nationwide, ranked Colorado as the number four state with the most startup activity, attributing 350 people out of every 100,000 adults becoming entrepreneurs each month.

Filling the gap for those entrepreneurs who are unable to work from home or want to expand their presence beyond meetings at the local coffee shop, co-working spaces are popping up all over Denver and taking over vacated office space. WeWork Denver Union Station location just opened their doors in mid-April and took over approximately 69,000 SF, with their LoHi location occupying about 73,000 SF at the Lab on Platte building. Additional co-working companies claiming real estate ranging from 13,000 SF to 152,000 SF in Denver include:

– Industry boasts 152,000 SF of office space in RiNo

– Galvanize recently added a second location at 50,000 SF on Platte Street

– Spaces Denver currently renovating 35,000 SF in Ballpark area

– Modworks now occupies 13,000 SF in the Petroleum Building

With headlines of bankruptcy, job cuts and continued low oil prices, the decline of oil and gas companies in Colorado is spilling over into the commercial real estate market. This resulting abundance of office sublease space allowing new tenants such as co-working companies to occupy the CBD, has the potential to alter the office real estate culture in downtown Denver. Sheldon Shadrach, Area Manager for Spaces Denver, comments, “Our office is a prime location and allows us to focus on a creative, niche market where we can redefine how people work and enjoy the office space where they work.”

Graph courtesy of JLL Research

Photos courtesy of Spaces Denver