Momentum slowed in the second quarter for the U.S. life sciences real estate market, though several indicators portend long-term expansion for the sector, according to a new report from CBRE.

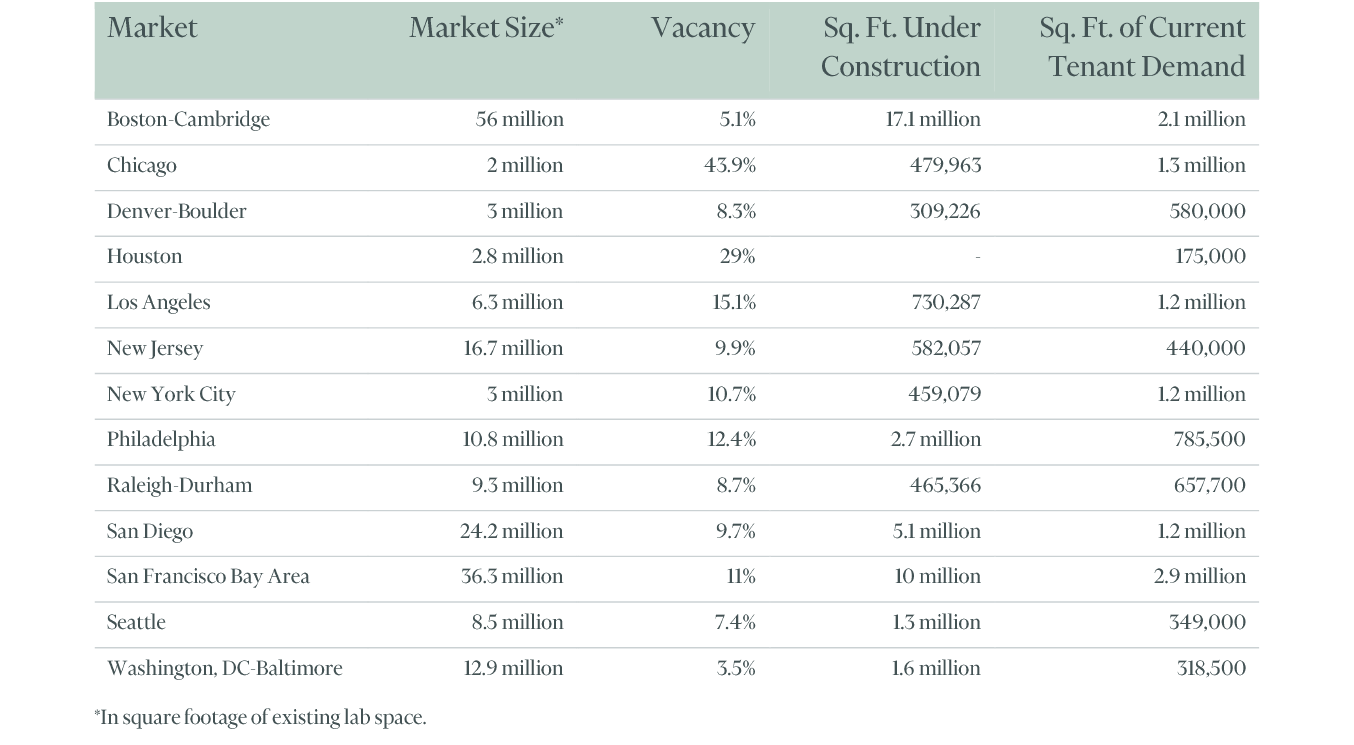

Vacancy for lab space across the 13 largest U.S. life sciences markets registered 9% in the second quarter, up two percentage points from the first quarter and up four points from a year earlier. The average asking rent increased by 3% from the first quarter to $66.31 per sq. ft., mainly due to the completed construction of new, high-end lab space.

The vacancy increase resulted mostly from the newly completed construction, which added 3.4 million sq. ft. of lab space to the 13-market total. That newly completed space was 45% leased prior to completion.

Metro Denver Fundamentals

Lab vacancy also rose in Metro Denver in the second quarter, up to 8.3% compared to 6.0% a quarter earlier and 4.3% a year ago. Though climbing, the vacancy rate in the market, which includes Aurora, Boulder, and Denver, is the fourth lowest among the 13 leading U.S. life sciences markets tracked by CBRE.

A pipeline of new and converted life sciences projects is expanding the inventory of lab, research & development, and good manufacturing practices (GMP) facilities in the Denver market and increasing the region’s vacancy rate. Developers completed two projects totaling 76,000 sq. ft. in the first quarter, and there are 10 other lab projects plus one manufacturing project set to deliver by year-end 2024, totaling nearly 390,000 sq. ft. Approximately 33% of the pipeline is preleased.

Demand from life sciences companies seeking to locate in greater Denver is fueling development. There are 19 companies seeking a cumulative 580,000 sq. ft. of life sciences space across the metro area as of the end of the second quarter.

“Denver-Boulder’s lab vacancy rate is climbing but remains among the lowest in the nation. We anticipate vacancy will continue to rise in the short term as new life sciences projects deliver, and it naturally takes some time for new facilities to be fully leased,” said Erik Abrahamson, senior vice president with CBRE’s Life Sciences practice in Boulder.

He continued, “It’s important to understand that the greater Denver area is on the edge of a major shift in its life sciences sector. Unprecedented demand over the past three years has caught the attention of the nation’s most sophisticated life sciences developers. These developers acquired over 1 million sq. ft. in Boulder last year alone and are working on speculative facilities that will compete with the best labs on the coasts and at more affordable rates. While the national pullback in venture capital funding is causing some companies to delay leasing decisions, the Denver-Aurora-Boulder area continues to see strong funding, research talent growth and steady preleasing.”

Venture capital funding for life sciences companies in the Denver metro area rose to $119.9 million in the second quarter of 2023, its highest total since the fourth quarter of 2020 and a 53% increase quarter-over-quarter. National Institutes of Health (NIH) funding is also on pace for a banner year, totaling $265 million in the first six months of 2023, more than half of 2022’s record-high sum.

More Growth Ahead

Additional measures point to continued growth for the sector. Denver’s life sciences talent pool grew 35% between 2017 and 2022, the second-fastest growth rate of any major U.S. market, propelling Denver-Boulder into the nation’s top 10 markets for life sciences research talent, per CBRE’s annual analysis.

U.S. life sciences employment growth, while slowing in recent months, still exceeds the rate of overall U.S. job growth. Announced layoffs in the sector declined from February through June.

“The life sciences sector has gone from 150 mph to 100 mph, but the underlying science is robust and healthy,” said Matt Gardner, CBRE Americas Life Sciences Leader. “The volume of second- and third-stage clinical drug trials continues to grow. Laid-off talent is finding work with other companies in the sector. The easing of historically tight vacancy will benefit occupiers.”

To read the full report, click here.