CoworkingCafe just released its State of Coworking Industry Report, leveraging proprietary data as of October 2025. The analysis breaks down coworking space stock availability across the 50 largest markets, along with their size and distribution, subscription prices, and top coworking operators.

Here are more details on where the Denver coworking market stands:

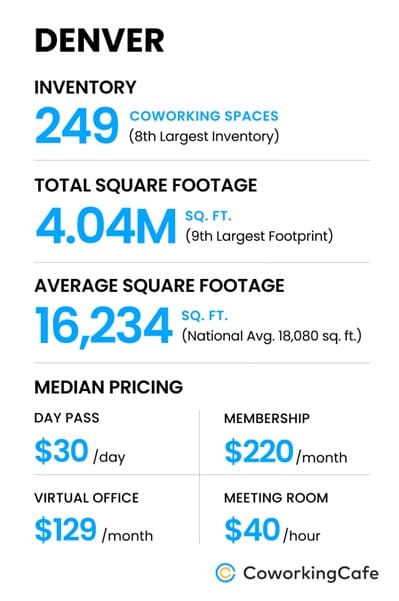

- Inventory: The Denver market currently has 249 coworking spaces — the eighth-largest inventory among the top 50 markets.

- Total Square Footage: Denver registered 4.04M sq. ft. of coworking space at the end of Q3 2025 – the ninth-largest number.

- Average Square Footage: the average square footage stands at 16,234 sq. ft. in Denver. That’s on the smaller side, with the national average currently at 18,080 sq. ft.

- Pricing: Virtual offices were $129/month at the end of Q3, below the national level, sitting at $159. Meeting rooms sat at $40/hour, below the national level of $45, while a day pass had a median cost of $30, on par with the national at $30. Memberships were $220/month, slightly below the national median at $225.

- Operators: The top five operators in the Denver market are Regus (42 spaces), Humanly (16 spaces), Office Evolution (12 spaces), Spaces (six spaces) and WeWork (six spaces).

National snapshot:

- Total national inventory stands at 8,420 coworking spaces spread across 152M sq. ft.

- The top five operators nationwide are Regus (1,185 spaces), HQ (341 spaces), Industrious (168 spaces), Spaces (168 spaces) and WeWork (148 spaces).

You can read the full industry report here: https://www.coworkingcafe.com/blog/national-coworking-report/