With e-commerce at an all-time high, the pandemic has proved to be a beneficial time for the Denver industrial sector. According to Newmark Q4 2020 Denver Industrial Market Report, annual net absorption totaled 2.3 million square feet, the highest of any asset class in Denver. And, moving into 2021, development is not projected to slow down.

Several large distribution centers are expected to deliver this year in Denver. Roughly 4.0 million square feet of industrial product is set to come on line during the first quarter of 2021 alone and over 7.0 million square feet is slated to deliver by the end of 2021.

North Central Logistics Center is on pace to deliver three buildings in the 1st quarter of 2021 accumulating to over 650,000- square feet. 2999 Picadilly is set to deliver in 2021 with a 900,000-square-foot Shamrock Foods Build-to-suit property. Stafford Logistics Center (20500 East Colfax) is also set to deliver in 2021 as a 526,499-square-foot industrial property owned by NorthPoint Development.

Report Highlights:

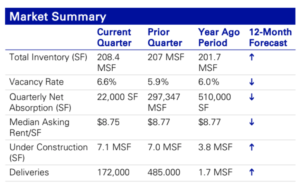

- Denver industrial market posted 23,000 square feet of net absorption for the fourth quarter of 2020.

- Northwest submarket posted the largest negative net absorption for the fourth quarter at 265,912 square feet. The vacancy rate increased to 9.9% in quarter four, up from 8.2% in quarter three.

- The industrial/warehouse subtype of industrial lead the way in absorption for 2020, which is different from years past as R&D/Flex space has led the way for the past 10 years.

- Rental rates stayed level throughout the quarter due to a lower demand of space with the excess of new construction. Southeast and West were the leading markets in rental rates over $10 per square foot, with Northwest and Southwest close behind. The average market rent for Industrial and R&D Flex is $8.79 per square foot, which is a 10-year high.

- Large corporations are occupying industrial/warehouse space leading to increased absorption and the smaller businesses are occupying R&D/Flex space which has led to negative absorption and space being vacated with increased struggles due to the pandemic.