In Q4 2021, the Denver industrial market recorded record-breaking stats across all metrics, according to CBRE’s Q4 report on Denver industrial.

Vacancy and Availability

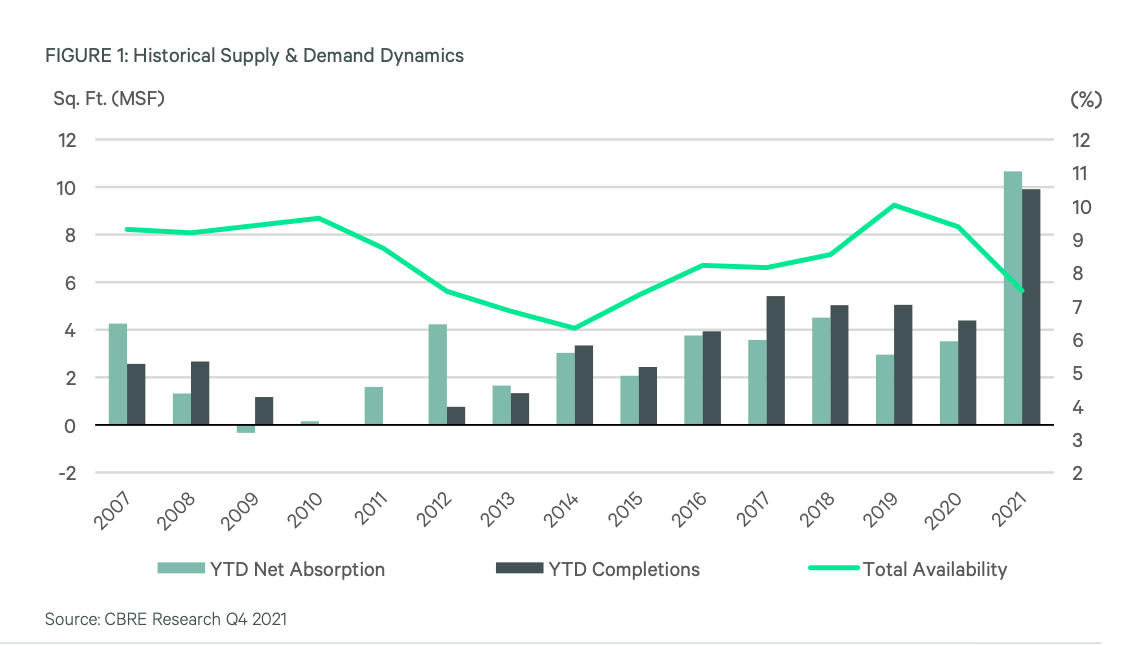

The total availability rate continued to compress in Q4 2021, falling 192 bps year-over-year to 7.5%. Direct vacancy fell to 5.4%, a decline of 117 bps year-over-year. Despite increased supply, these declines were driven by one of the highest quarterly leasing volumes in recent years paired with record quarterly absorption levels. With nearly every submarket in Denver seeing a decline in direct vacancy from Q4 2020, the Airport submarket stood out with a notable 280 bps drop from 7.1% to 4.3%, marking one of the largest year-over-year declines across the metro area.

Net Absorption

Positive total net absorption of nearly 5.9 million sq. ft. was recorded in Q4 2021, the highest quarterly total ever recorded in metro Denver. Annual absorption in 2021 reached a record 10.7 million sq. ft., more than three times the total posted last year and nearly double the previous record of 5.5 million sq. ft. recorded in 2006.

The Airport submarket continued to be the primary driver for quarterly activity, recording over 4.4 million sq. ft. of positive net absorption and pushing its annual share to 64.1% of all net absorption recorded in 2021.

Net absorption was largely driven by build-to-suit activity this quarter. Significant BTS move-ins included Amazon occupying a total of 1.4 million sq. ft. across two projects in the Airport submarket and Lowes moving into its new 1.0-million-sq.-ft. building at Nexus at DIA. Speculative users contributed to the record absorption total in Q4 as well, with FedEx occupying 473,756 sq. ft. at North Central Logistics Center, Alan Ritchey filling 594,138 sq. ft. at Stafford Logistics Center, and Americold moving into 243,854 sq. ft. at the newly delivered cold storage project, 76 Freeze.

Average Lease Rates

The average asking lease rate reached $8.81 per sq. ft. NNN in Q4 2021, recording 2.0% growth quarter-over-quarter and a marginal $0.03 decline year-over-year. Average asking rates in the Airport submarket showed slight growth to $6.57 per sq. ft. The achieved rate climbed 15.0% year-over-year to $9.36 per sq. ft. NNN. This quarter’s achieved rate surpassed the record-high pricing posted in Q3 2021, due in part to an uptick in flex and manufacturing deals executed at high rates this quarter along with consistent activity within the life science industry

Leasing Activity

Total leasing volume in Q4 2021 totaled 4.5 million sq. ft., a 44.9% increase quarter-over-quarter and nearly mirroring the total posted in Q4 2020. This quarter’s total pushed annual leasing activity to 14.4 million sq. ft., up 25.3% from 2020’s total and the highest total recorded in recent years.

Leasing activity this quarter was fueled by large deals. Twelve leases over 100,000 sq. ft. were inked in Q4 2021, highlighted by True Value Co.’s 355,630-sq.-ft. renewal at 11275 E 40th Ave in Denver, Hawthorne Hydroponics’ 201,104- sq.-ft. lease at Highpoint Logistics Park in Aurora, and Sherwin Williams’ 181,348-sq.-ft. renewal at the Majestic Commercenter. The Warehousing/Storage and Transportation/ Distribution industries continued to account for the largest share of activity this year, with 3PL companies the demand driver. New leases comprised 67.6% of the activity in Q4 2021, with significantly more deals in the 100,000 to 250,000-sq.-ft. size range compared to previous quarters.

Development Activity

The volume of projects under construction continued to increase in Q4 2021, exceeding 10.1 million sq. ft. This volume marks the highest quarterly total ever recorded in the metro Denver area. Of the total, 9.1 million sq. ft. (89.8%) is concentrated in spec projects. Only 1.8% of the 9.2 million sq. ft. of spec space under construction was preleased as of Q4 2021. Notable projects underway include the 626,000-sq.-ft. Building 1 at DIA Logistics Park at Porteos and the 588,085-sq.-ft. First Aurora Commerce Center Building E, both located in the Airport submarket.

Thirteen projects totaling just over 3.6 million sq. ft. delivered this quarter, pushing the annual total of completed projects to nearly 10.0 million sq. ft. Of the quarterly total, which was largely driven by BTS projects, was 80.9% preleased. The delivery volume recorded in 2021, which was more than twice the amount of the previous year’s total, marks the largest annual delivery volume ever recorded in the metro Denver area. While the largest share of development activity remains in the Airport submarket, the northern Denver area is beginning to see a surge with an increased amount of sizable projects both under construction and proposed in the I-76 Corridor, North and Northwest submarkets.