By Katie Rapone, editor Mile High CRE

The Urban Land Institute’s Emerging Trends in Real Estate® 2021 report highlights the trends shaping the real estate industry. The report, which includes proprietary data and insights from more than 1,600 leading real estate industry experts, explores how COVID-19 accelerated many existing trends like retail footprint reductions, spawned new ones such as an increased focus on social justice and health and wellness, and slowed the appeal of big cities.

In light of the report, a panel of local experts recently discussed the trends and observations specific to Colorado markets. The virtual event, sponsored by Newmark, was hosted by Kevin McCabe, executive vice president and central region market leader with Newmark.

Colorado Economy

Unemployment in the state remains a concern. 343,000 jobs were lost over three months (Jan 2020-April 2020) in the state. According to Patty Silverstein, president & chief economist at Development Research Partners, a worse case scenario would be that numbers could take as long three years to recover to the levels we had prior to COVID. However, that recovery date is more likely to be closer to the end of 2022.

Colorado is experiencing job losses across the state. Grand Junction is performing the best while Boulder is performing the worst, likely due to the fact that the city is so influenced by student activity and tourism.

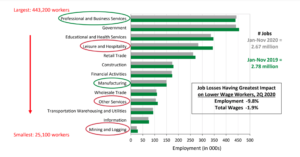

Colorado’s Professional and Business Services employment supersector, which includes architecture and design, is actually increasing. Manufacturing is also doing well in the state, especially the aerospace industry. Leisure and hospitality have however been severely impacted as the graphic demonstrates.

Despite contrary popular belief, Colorado’s population has been growing very slowly, the slowest rate since 1990. In 2020, Colorado only saw a 1 percent increase in population, likely due in part to the COVID-19 pandemic. However, Colorado was still ranked the 12th fastest growing state between 2019 to 2020.

Office

- Perhaps the biggest trend accelerated by the pandemic is working from home (WFH). 52 percent of ULI survey respondents strongly agree that in the future, companies will allow employees to work remotely at least part of the time. However, in-person workplaces are critical for company culture, innovation, onboarding of new employees, and training. Plus, WFH may be a challenge for younger and lower-income workers due to space and connectivity issues at home.

- Office tenants will require more square feet per worker post-COVID due to the newly ingrained, but expected to be long-lasting, health concerns.

- Many office tenants will use WFH to shrink their footprints as a cost-saving measure, as well as an employee benefit. The overall impact on total office demand is unclear, with experts’ forecasts ranging from minimal impact (WFH reductions offset by lower density) to an overall decline in office space demand of 10 to 15 percent.

“Many tenants are looking at this pandemic as an opportunity to rethink their space.” said Chad Brue, CEO and founder of Brue Baukol Capital Partners. “They are hesitant to make any long term decisions and there has definitely been a shift towards suburban and spreading out more. We have tenants that are looking for more low-rise and mid-rise buildings.”

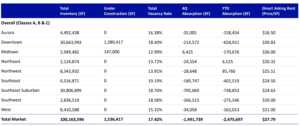

2020 saw 2.5MSF of negative absorption in the Denver office market and a vacancy rate of 17.4% according to Newmark Research, yet Denver currently has 1.3MSF of quality office space currently under construction, including McGregor Square, Block 162, Vectra Bank HQ and One Platte.

Thomas M. Lee, executive managing director at Newmark, expects tenants’ “flight to quality” to continue into 2021 as many companies seek out high quality, new-build office space. While the first half of this year is predicated to be slow, Lee expects the second half to pick up substantially due to the pent up demand and the fact that people are tired of working from home.

“As I look at bright spots in Denver for 2021, I think you will see some things happen at Peña Station, somebody break ground in RiNo — I think there’s a lot happening at Broadway Park, Baseline at 470 and I25, and Cherry Creek will do very well, as well as Union Station,” said Lee. “I’m convinced you are going to see big Tech companies making big commitments to Denver. I think we are well positioned with all of our infrastructure for big growth in this next decade.”

Retail

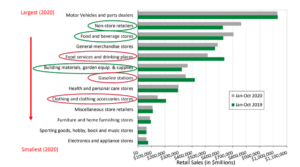

- National consumer spending patterns have shifted dramatically, favoring e-commerce during the pandemic.

- The retail property sector must right-size and reinvent. Retailers and shopping centers were already struggling before COVID-19, and now conditions threaten to worsen materially as the pandemic and its economic fallout accelerate the pace and magnitude of preexisting issues.

- People still purchase the vast majority of their retail products and services in stores, and some current set-backs will prove to be only temporary once it is safe to shop, socialize, and recreate.

- The industry, however, faces a painful shakeout as small businesses and familiar national brands shutter their doors, shrinking the ranks of tenants for shopping centers and driving down occupancy and rents.

Robb Brown, president and CEO at Denver Retail Group spoke to Denver’s retail market. According to Brown, retail centers that offer a more diverse and inclusive environment in which to shop, will fair the best.

“In order to have a successful project, you’re going to have to mindful of how diverse and inclusive your project is, who the players are at the table helping you design the project, so that you can attract consumers, visitors and the best retailers,” said Brown.

Pre COVID-19 mixed-use development reigned supreme and has been very successful, said Brown. But the pandemic has made it important to be responsive and intentional with the purpose of real estate. For example, restaurants may need to rethink underutilized dining space and repurpose in a different way. “The more responsive you can be about the uses and utility of real estate, the more enduring that real estate will be and the bottom line will show the benefit of that thoughtful approach as opposed to the old paradigm that we really can’t do any longer.”

Hospitality

- Health and well-being will become more important factors across all sectors of real estate but particularly in the hospitality world which is dependent on people feeling comfortable traveling.

- A significant single-family-housing market trend emanating from the COVID-19 pandemic is “the Great American Move.” People (and businesses) are moving in all sorts of ways — to different geographies, from denser cities to the suburbs, from an apartment to a home, and, for some, back “home” to live with family members.

- The increased focus on health safety is expected to lead to new services and technologies that provide cleaner buildings/indoor air, sensors, touchless entry, and so on.

Becky Stone, principal of OZ Architecture spoke to the trends shaping the hotel resort sector. With 70 percent of the top income earners working from home, record-breaking numbers of people are purchasing homes in resort communities. According to the Aspen Times, Pitkin County hit 3.1 billion in property sales on January 3, the highest since 2006.

The pandemic has increased demand for larger single-family homes as well as multifamily residences. “Residents want larger living spaces, bigger kitchens and want to be able to separate one generation from another, ” says Stone. In addition to larger living spaces, there is also a trend for larger indoor/outdoor spaces in order to take full advantage of the mountain air.

Within the resort world there is a demand for more “retreat properties.” According to Stone, these properties offer membership club/corporate retreat type amenities such as co-working, spa, and fitness, with an emphasis on open space to meet the demand for more outdoor recreation. OZ is also seeing an uptick in demand for more cabin style product instead of the lodge style properties of the past.

Affordable Housing

- 1,046 low income apartment communities in Colorado (Affordable Housing Online).

- High-cost (relative to income) and inferior-quality rental housing has been linked to numerous negative social outcomes, including worse health, decreased life expectancy, inferior education, and lower incomes.

- Finding solutions to housing availability and affordability will be very difficult and require many more resources from both public and private sources than are available now. But that is no reason not to push hard.

As a developer, Chad Brue, Brue Baukol Capital Partners, struggles with municipalities that don’t want more residential in their communities. “They want commercial they just don’t want residential, ” said Brue. “If you restrict supply of housing in these communities then by definition, you are increasing the price. The demand to live in Colorado is not going to change. These communities that are restricting supply are hurting their main objective which is to gain more affordable and more obtainable housing.”

To read the full ULI report click here