Following years of volatility, the energy sector’s share of downtown Denver’s office market has stabilized, according to new research from CBRE.

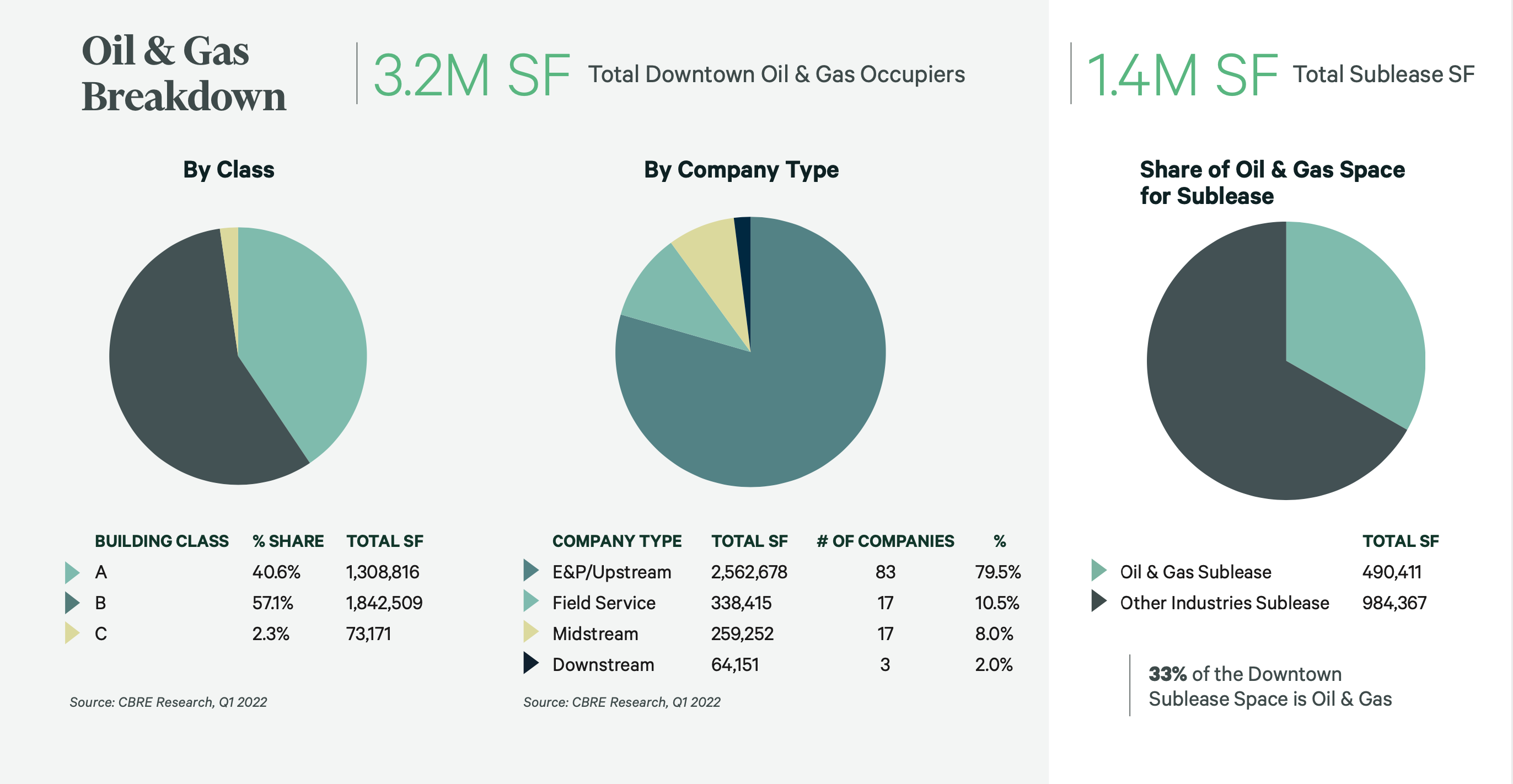

Oil and gas companies occupy 3.2 million square feet in downtown Denver as of the first quarter of 2022, accounting for 10.6 percent of downtown’s occupied office footprint. This is down from approximately 20 percent in 2015 and 50 percent at the height of the industry in the 1980s.

“Ten percent is a stable energy presence in downtown Denver, and stable is a great place to be in an industry that has seen dramatic pricing fluctuations and a large amount of consolidation activity over the past seven years,” said Anthony Albanese, senior vice president with CBRE.

After several years of rapid growth, oil prices took a turn in 2014, plummeting from $107 to $44 a barrel. After temporarily rebounding, they went negative for the first time in history in April 2020.

Declining prices led to extensive industry consolidation with larger organizations absorbing smaller oil and gas firms in Denver. Many of those firms either let their office leases expire or put their space on the sublease market. Oil and gas sublease space peaked in 2021 and remains elevated today. There is approximately 500,000 square feet of energy space available for sublease in downtown Denver, representing one-third of all sublease availability.

Silver Lining for Class B Office Space

Despite elevated levels of sublease space, the energy industry continued to lease office space over the course of the pandemic. The sector-led office leasing activity downtown from Q2 2021 through Q1 2022, accounting for 25 percent of all activity, just ahead of tech at 24 percent. Historically, energy has represented 20 percent of downtown office leasing activity since 2015.

CBRE’s analysis found the majority of energy’s office footprint downtown is in Class B space (57 percent), followed by Class A (41 percent) and Class C (2 percent).

“The volatility in the energy industry has made oil and gas companies conservative users of real estate. They generally have office-centric cultures but do not require the flashiest real estate. While we are seeing a flight-to-quality among other office-using industries, the energy sector is providing healthy demand for Class B+/A- space, boosting the overall strength of downtown Denver’s office market,” said Albanese.

Global Impacts

The war in Ukraine and global shifts away from reliance on Russian oil have contributed to a dramatic spike in oil prices this year. Prices have approached $120 a barrel this month. Additional domestic supply could alleviate some of the upward pressure on pricing, but there are challenges to expanding drilling operations.

“With current pricing, many assume oil and gas companies are making money hand over fist and that production will immediately rise. While current prices have helped repair corporate balance sheets, there are headwinds to production, including restrictions limiting the ability to quickly expand drilling operations. Many of these are well-intentioned with environmental impact top of mind; however, they do increase costs and restrict supply.

Production also faces headwinds in the form of supply chain constraints, inflation in materials and equipment cost, and low unemployment, which makes it hard for companies to hire the employees needed to work in the field despite increasing wages. This makes the expansion of domestic drilling a slow process, which can be frustrating to people looking for immediate relief at the gas pump,” added Albanese.