This week, CBRE released its Q2 reports for metro Denver’s office and industrial sectors. The Denver office market felt the impact of the recession brought on by the COVID-19 pandemic. For the first time in 13 quarters, the market saw negative absorption activity of 84,706 square feet in Q2 2020. Conversely, the industrial sector held steady this quarter. Metro Denver saw its 41st consecutive quarter of positive net absorption, recording almost 1.3 million square feet of net absorption in Q2.

Q2 Office Highlights – Metro Denver

Q2 Office Highlights – Metro Denver

- Metro Denver posted 84,706 sq. ft. of negative net absorption in Q2 2020.

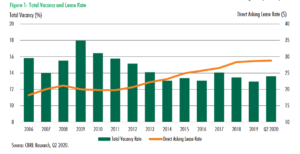

- The average direct asking lease rate remained stable at $28.81 per sq. ft. FSG.

- Total vacancy increased 55 bps quarter-over-quarter to 13.6%.

- Sublease availability increased 33.3% quarter-over-quarter to 3.4 million sq. ft. This uptick drove total availability to 17.8%, a 91 bps increase from last quarter.

- The total construction volume reached 3.7 million sq. ft., up 49.8% year-over-year.

- Two projects broke ground this quarter, the 64,000-sq.-ft. office building at 240 St. Paul St in Cherry Creek and the 43,500-sq.-ft. adaptive reuse project, Emily’s Office in the Downtown submarket.

Q2 Industrial Highlights – Metro Denver

Q2 Industrial Highlights – Metro Denver

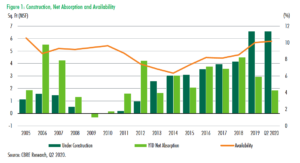

- Almost 1.3 million sq. ft. of positive net absorption was recorded in Q2 2020—a 32.1% increase from Q2 2019.

- The overall average achieved lease rate for Q2 2020 fell 6.2% quarter-over-quarter to $7.53 per sq. ft. NNN.

- The overall average direct asking lease rate increased 1.3% quarter-over-quarter to $8.89 per sq. ft. NNN in Q2 2020.

- Direct vacancy rose 45 bps quarter-over-quarter to 6.9%, while availability increased by 107 bps to 10.2% in Q2 2020. These increases were largely driven by the rising amounts of sublease space on the market.

- Twelve buildings comprising 2.4 million sq. ft. delivered in Q2 2020 while construction activity remains elevated with 6.6 million sq. ft. underway.

- Notable projects under construction include Shamrock Foods’ 900,000- sq.-ft. BTS and Stafford Logistics Center Building 1, totaling over 594,000 sq. ft. of spec space, both located in the Airport submarket.