RCLCO Real Estate Consulting has released a new in-depth national research report on the consumer preference of renters.

The 2023 Renter Consumer Preference Survey Report shares data from a comprehensive national survey, conducted in late 2022, that illuminates the motivations, product type preferences, and locational considerations that are driving today’s renters of both multifamily and single-family product.

Due to the continuing structural undersupply of rental housing and strong market fundamentals, and with the pipeline of new deliveries slowing in 2024 and 2025, now is a good time to be planning new multifamily and build-for-rent units for the 2024 to 2025 timeframe. The consumer research data included in RCLCO’s 2023 Renter Consumer Preferences Report is intended to provide insights regarding who renters are and what they’re looking for in new rental housing.

“Rental household demand has been increasing ever since the economy reopened in 2021, yet there isn’t enough attention paid to shifting preferences and behaviors of this group,” said Gregg Logan, managing director at RCLCO. “We think this data will be invaluable to builders, developers, property managers and architects when designing and renovating rental communities of all types.”

5 Featured Findings

1. The finding from this research was that while only 40% of respondents in RCLCO’s recent renter survey currently live in a single-family detached unit or a townhouse, 51% say their ideal rental unit type is a single-family home and 21% prefer a townhouse or duplex – 72% overall. Whether or not these renters can find and afford a lower-density rental home in their market is of course a challenge to them realizing that preference, but clearly there is strong interest.

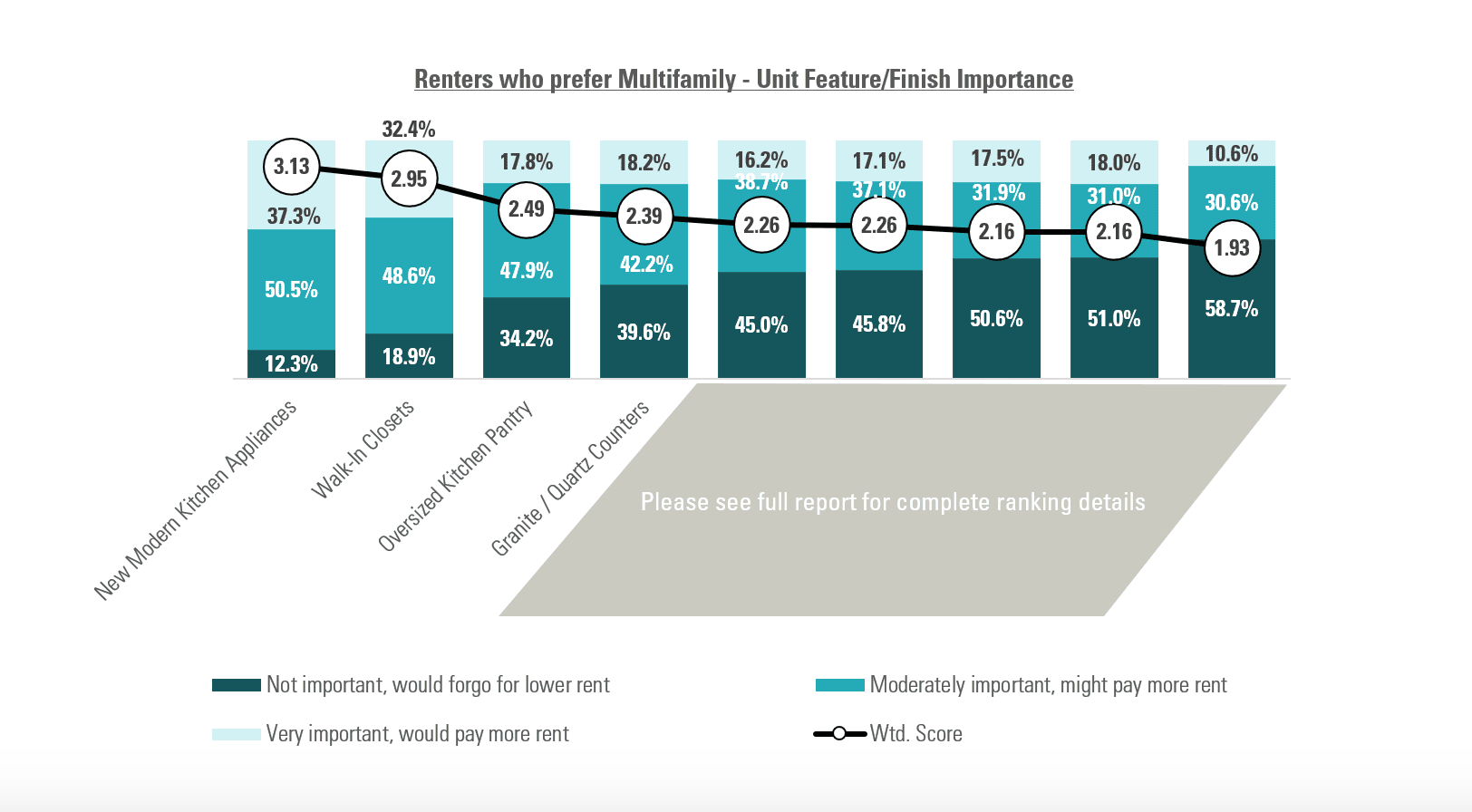

2. Closets and Kitchens have the most impact in terms of a modern multifamily renter’s willingness to pay more for a luxury unit. Interestingly finish preferences did not vary dramatically even for those with higher income levels.

3. Secure package receiving options are the #1 ranked amenity by young singles, couples, and roommates under age 55, as the popularity of online shopping continues to rise.

4. If you are a developer targeting a significant share of family renters, it may make sense to forgo development dollars spent on a business center, dog wash, and media/game room – as those ranked lowest on this segment’s priority list.

5. 62% of renters who are 55+ prefer either an age-restricted or an age-targeted community, with many mature renters.