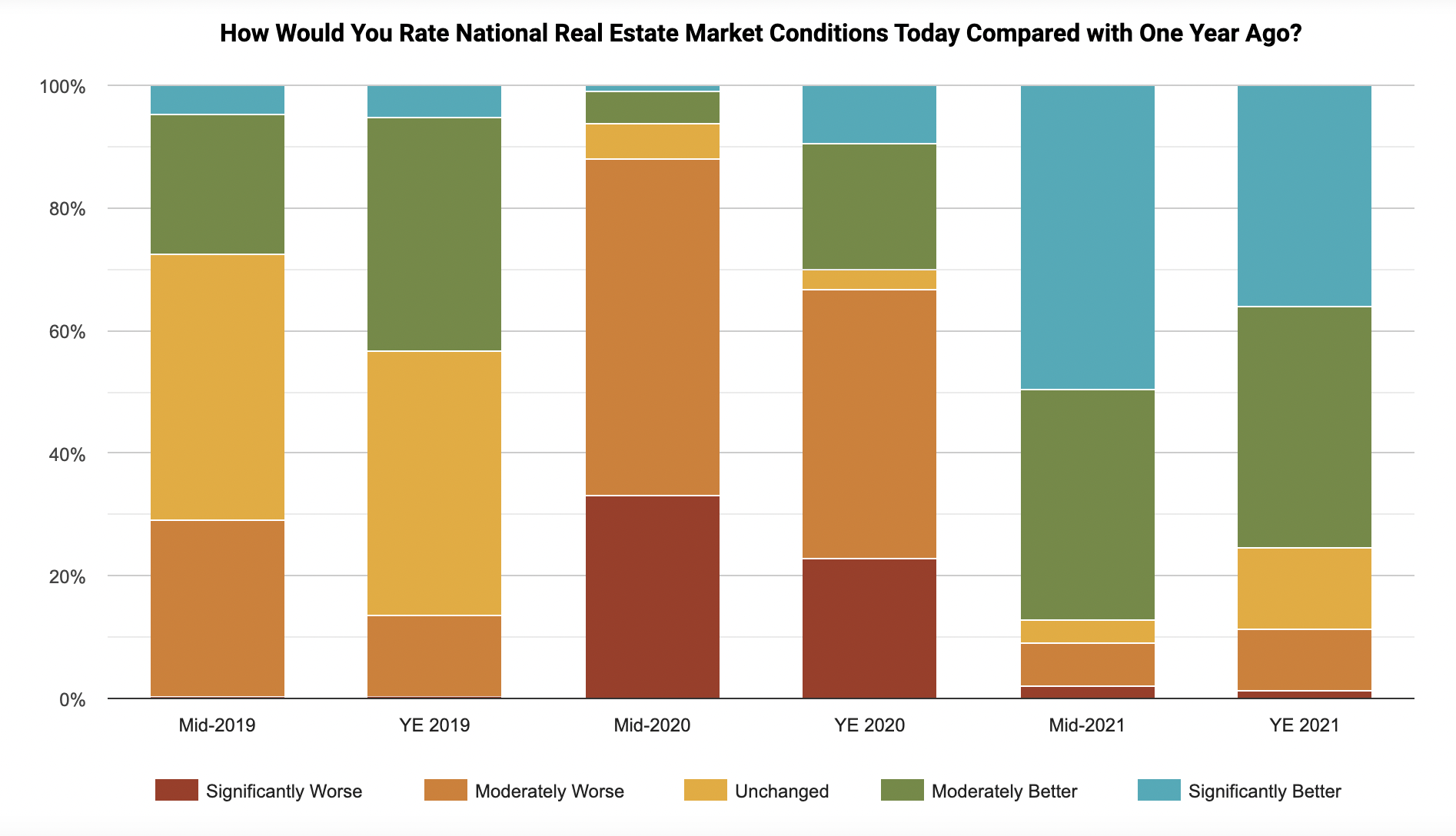

The RCLCO’s Real Estate Market Sentiment Survey that tracks confidence in U.S. real estate market conditions, took a dramatic dive in mid-2020 due to the speed and intensity of the economic downturn sparked by COVID-19, hitting its lowest level in the history of the series (9.2). Market sentiment spiked to 89.1 in mid-year 2021, as vaccination rates rose, new cased dropped, business restrictions were lifted and the economy and real estate markets started to recover. The Year-End 2021 result shows a more tempered sentiment of 82.1 as new variants have emerged in the second half of the year that are more transmittable and vaccine-resistant and as concern about inflation increases.

Key Takeaways

- The RCLCO Current Real Estate Market Sentiment Index (RMI), which measures sentiment on a 100-point scale, has decreased 7.0 points over the past six months, from 89.1 at MY 2021 to 82.1 at YE 2021, still well above the long term (since 2011) average of 69.4.

- Respondents predict that real estate market conditions will continue this gradual decline, with the RMI anticipated to drop 13.1 points to 69.0 over the next 12 months. This would bring sentiment in line with average levels over the past 10 years.

- Just over half of survey respondents (57%) believe real estate conditions will remain moderately or significantly better in the next 12 months.

- A majority of respondents believe Covid-19 will cause a reduction in long-term office demand compared to pre-Covid estimates, with 41% predicting a 10-20% reduction, followed by 36% predicting a slight 0-10% reduction.

- The apartment market boom will continue for at least another year – nearly half of the respondents indicated apartment rent growth would remain somewhat above historical levels (5% to 8% growth) in 2022.

- Respondents indicate that many product types have moved from Early Recovery to Early Stable phases since the MY 2021 survey. Retail still remains at the bottom of the cycle due to ongoing disruption from Covid-19, though both office and hospitality have reached early expansion. Encouragingly, retail is expected to return to Early Recovery within the next 12 months.

- Looking ahead a year, a majority of respondents expect interest rates to rise, inflation to increase, and capital flows to increase to real estate. Respondents were split about homeownership rising or remaining constant. The was also less consensus over the expected performance of cap rates over the next 12 months, though slightly more predicted an increase than at mid-year.