In 2023, life sciences companies had to quickly pivot and learn to do more with less as funding fell from record-high levels. According to the Q4 Life Sciences Tenant Report just released by leading global real estate services firm Savills, leasing activity from the sector slowed as tenants became highly cost-conscious. This shift in demand, combined with significant amounts of new inventory from bullish developers, has changed the supply and demand dynamics in favor of tenants.

Key Takeaways:

- Government Support – Federal and state-level governments are working to help grow the life sciences industry, with officials increasing investments and offering more incentives for companies across the nation.

- Pharmaceutical & Biotech Showing Strength – In 2023, drug discovery and biotech verticals received the most venture capital funding across all major life sciences markets.

- Post-Covid Normalization – After a pandemic-fueled boost to the sector, life sciences companies have adjusted to market normalization and may be more comfortable making real estate decisions moving forward.

Denver-Boulder market:

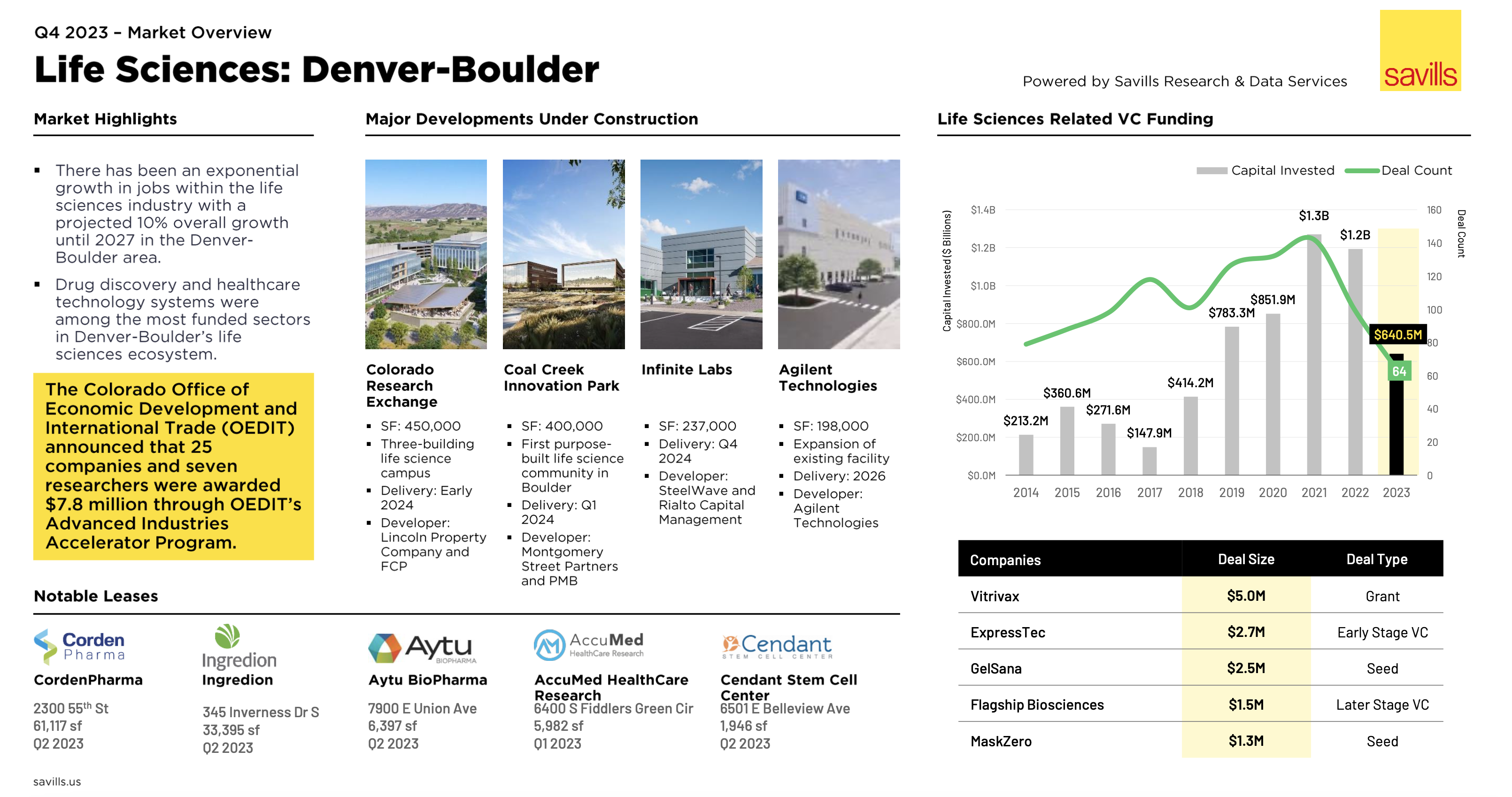

- There has been an exponential growth in jobs within the life sciences industry with a projected 10% overall growth until 2027 in the Denver-Boulder area.

- Drug discovery and healthcare technology systems were among the most funded sectors in Denver-Boulder’s life sciences ecosystem.

- The Colorado Office of Economic Development and International Trade (OEDIT) announced that 25 companies and seven researchers were awarded $7.8 million through OEDIT’s Advanced Industries Accelerator Program.