By Drew Isaac, First Vice President Investments and Ryan Bowlby, Senior Associate, Marcus & Millichap.

Denver’s retail market is benefitting from healthy employment growth, rising incomes and fundamentally sound new developments. Employers in energy, telecom and IT are creating well-paying positions, leading to an increase in disposable income and a boost to local retailers. In 2017, retail sales soared by 6.5 percent, well above the national growth rate. A booming local housing market is also supporting the retail market. Quarterly existing single-family home sales are at peak levels, driving sales for big-ticket items and home furnishings. This year, retail sales are projected to climb more than 5 percent.

The local market is not without some headwinds, including tight labor conditions. The unemployment rate has been below 3 percent range since the end of 2016, which has stymied job growth. Nonetheless, payroll expansion is still outpacing the national average as firms such as BP and SendGrid are adding to headcounts. BP is hiring for its new Denver headquarters, which opened in the first quarter, and will employ approximately 200 when fully staffed. SendGrid, meanwhile, is hiring hundreds of new positions at its consolidated location in downtown.

Supply growth will reach a new cyclical peak this year, though the impact on overall occupancy rates will likely be nominal. Approximately 1.6 million square feet of retail space is forecasted to be delivered in 2018. However, pre-leasing is north of 70 percent, limiting pressure on occupancy rates. The largest project underway is the 330,000-square-foot Denver Premium Outlets, which is scheduled to open this fall, prior to the holiday season. Two other significant projects are scheduled for 2018 deliveries, Johnstown Plaza and Vista Highlands will add nearly 400,000 square feet of retail space to the overall inventory. In addition, there are numerous smaller retail format buildings scheduled for delivery.

Development outside of retail is creating jobs, which will bode well for the local market. Denver International Airport is working on a $1.5 billion expansion that includes 39 additional gates, lifting the total number of gates to 150. Redbarre, a Denver-based media and tech consulting firm, is searching for land for a new campus. The project could ultimately include 70 acres and generate 4,000 jobs. Apartment development continues at accelerated levels as more than 14,000 units are slated for completion this year. Several major projects have lifted construction payrolls more than 25 percent over the last four years.

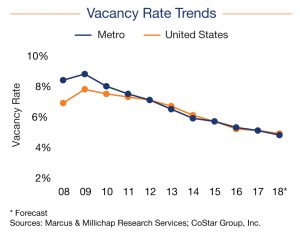

Healthy pre-leasing activity and strong absorption is keeping vacancy rates low while staying on the downward trajectory we have experienced over the last 20 quarters. At the end of the first quarter, vacancy was 5.1 percent, down 20 basis points annually. Demand is strong across the market, as only one submarket reported a vacancy rate above 6 percent at the end of the first quarter. The Northwest submarket posted a rate of 6.7 percent. This year, vacancy is anticipated to decline 30 basis points, finishing the year at 4.8 percent.

Healthy pre-leasing activity and strong absorption is keeping vacancy rates low while staying on the downward trajectory we have experienced over the last 20 quarters. At the end of the first quarter, vacancy was 5.1 percent, down 20 basis points annually. Demand is strong across the market, as only one submarket reported a vacancy rate above 6 percent at the end of the first quarter. The Northwest submarket posted a rate of 6.7 percent. This year, vacancy is anticipated to decline 30 basis points, finishing the year at 4.8 percent.

Rent growth is broad-based and healthy in Denver. In the last year, average asking rents climbed 4.8 percent. Nearly every submarket will post healthy gains again this year as rents are projected to advance by 5.1 percent to $19.07 per square foot. By year end, overall rents will be 26 percent above the recessionary trough.

On the transaction side, out-of-state capital continues to flow into Denver from coastal markets, as Denver’s strong economy has been well documented nationally and led to investors of all kinds targeting the Denver Metro Area. Many of these investors have found that appropriately priced, quality retail investments with strong underlying fundamentals are in short supply. At the same time, however, rising interest rates are creating upward pressure on capitalization rates. Buyers simply are unable to achieve the same after debt service returns they were able to generate even six months ago when the ten-year treasury was approximately 60 basis points less. Some of the increase has been absorbed by compression in interest rate spreads, but in general, we are still seeing debt quotes between 30-50 basis points higher than what could be achieved at the end of 2017.

The rising interest rate environment, combined with a steady drumbeat of negative headlines regarding the future of retail, has resulted in a widening spread between seller and buyer expectations on certain assets. Shopping centers, and single tenant assets, with strong credit tenants and long-term leases are trading at pricing (relative to income) that is stronger than pre-recession levels. However, retail assets that do not ‘check all the boxes’ are not achieving the prices that were achieved pre-2017. Buyers, often driven by questions and concerns from their lenders, are much more likely to discount a property’s value due to lackluster sales volumes, near-term tenant rollover, co-tenancy clauses, or poor general fundamentals (demographics, access, visibility, etc..). Key lease terms have always impacted a property’s value, but in today’s retail environment, they are more important than ever. While retail pricing may have peaked in 2016, from a historical perspective very strong pricing is still being achieved across most of the retail spectrum.

Images courtesy of Marcus & Millichap and CoStar Group, Inc.