In theory, analysis of market research can prevent the commercial real estate industry from repeating the mistakes of the past. Left unheeded, market research can only provide numbers and statistics.

by Julie Wanzer, LEED AP

As we “spring forward” into the second quarter of 2016, it can be beneficial to look back and evaluate the commercial real estate performance metrics from the previous quarter. CBRE Research recently published their coined Marketview(s) for the first quarter of 2016, covering several industry markets including, but not limited to, industrial and retail. The excerpts below highlight the trends from these two markets, which are both indicating low vacancy rates and positive net absorption.

Overall, the industrial market, which typically includes commercial spaces for warehousing, storage and manufacturing, is reporting a steady growth for the first quarter of 2016.

Trend: Demand > Supply

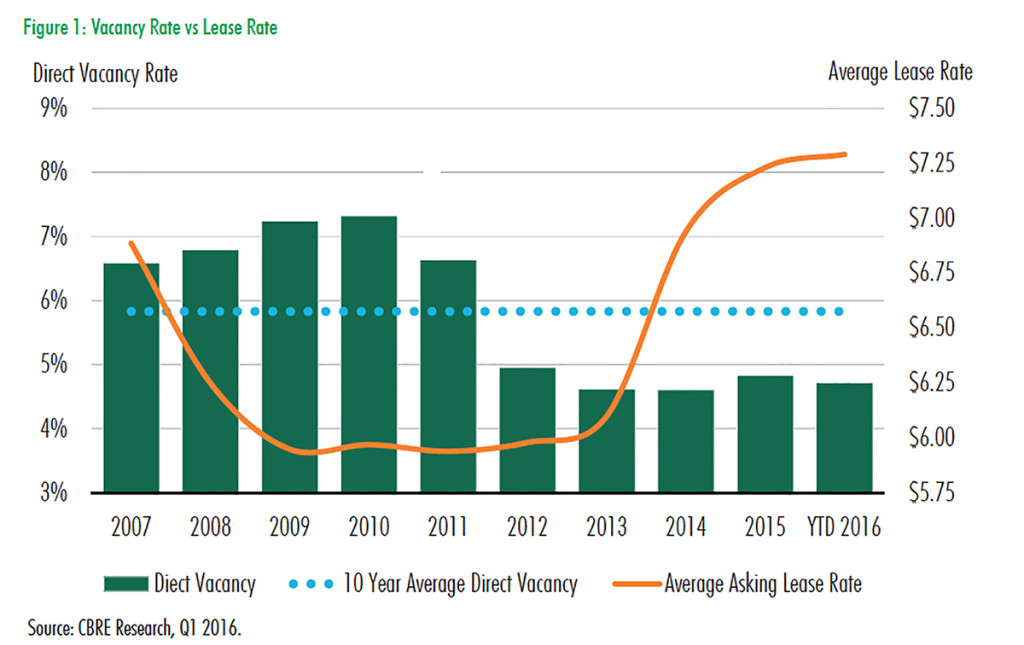

Demand currently outweighs supply for industrial space, which led to higher lease rates this quarter. This is evidenced by a $7.29/SF NNN (triple net) average lease rate, the highest rate to date and a 5.8% increase year over year.

Demand currently outweighs supply for industrial space, which led to higher lease rates this quarter. This is evidenced by a $7.29/SF NNN (triple net) average lease rate, the highest rate to date and a 5.8% increase year over year.

Jeremy Ballenger, vice president, CBRE Denver Industrial and Logistics Services, comments on this seller’s market for industrial spaces by noting, “In a strong market there may be many buyers for every seller, but to maximize price, an asset needs to be exposed to the best process to maximize competition and exposure to the best buyers. We routinely see assets trade at 10, 20, 30% above expectations due to competition and exposure.”

Trend: Drop in Vacancy Rates

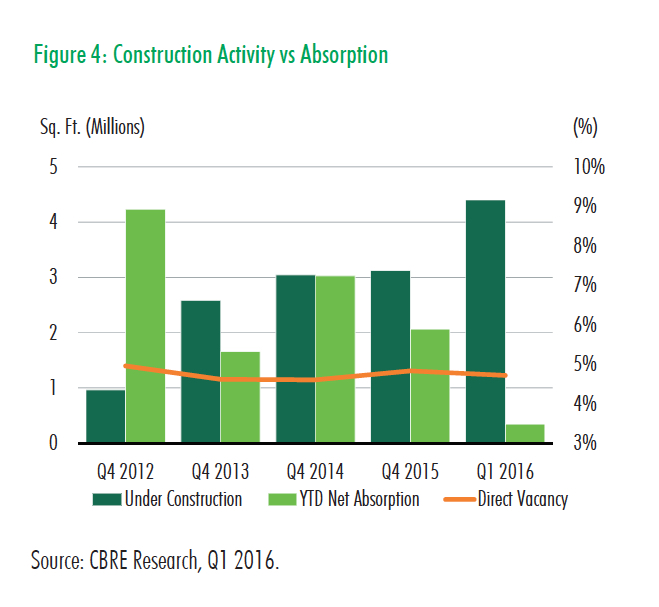

Denver’s under construction activity in the industrial market also reached a new high with 4.4 million SF in development, with a 4.7% direct vacancy rate – an 11 basis points drop from the fourth quarter of 2015.

CBRE Research accounts for 26 buildings under construction with the submarket categorized by DIA and Montbello as the strongest area with the most construction activity, at 2.7 million SF under construction. In addition to I-70, “This submarket provides superior access to other industrial logistics options such as the airport, rail, I-76, E470 and nearby I-25. This area [also] has the highest concentration of industrial within close range of Denver’s population, making it an ideal location for large warehousing, manufacturing and distribution uses,” comments Ballenger.

Investors are also particularly interested in this Airport/Montbello submarket with properties ranging from 7,000 SF to 15,000 SF in high demand.

CBRE Research reports that Denver’s retail market benefits from the currently low interest rates and strong residential market, which has supported an increase in consumer spending. Brad Lyons, senior vice president, CBRE Denver Retail Investment Properties also adds, “The multifamily market is creating density, which is a huge benefit for retailers in urban and suburban locations.”

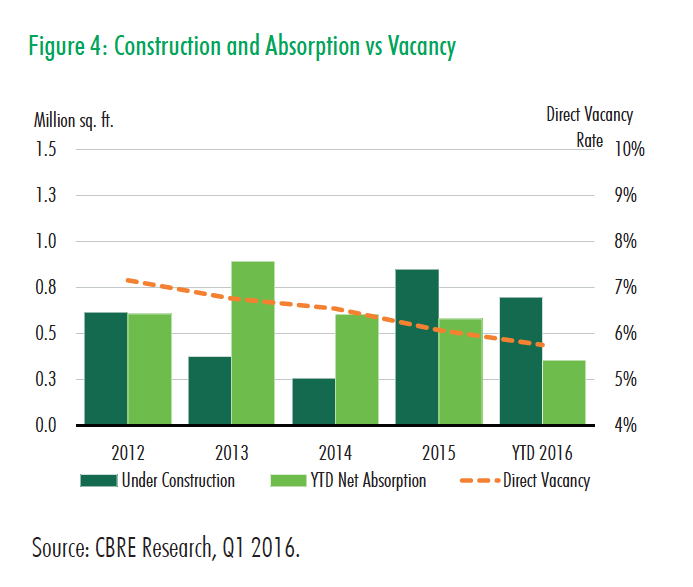

Trend: Historically Low Direct Vacancy Rate

With a direct vacancy rate of 5.8% – the lowest vacancy rate since 1998 – retail construction activity in the first quarter of 2016 reported nearly 323,000 SF of retail space added to the market, the greatest amount in five quarters.

Lyons accounts for this historically low vacancy rate in 18 years, despite the influx of new retail construction, by noting, “Most retail construction is not speculative and is comprised of build-to-suit work for specific retailers as well as shopping centers that are substantially pre-leased prior to construction.”

CBRE Research identifies the drivers of this new construction activity to include mixed-use retail with developers concentrating on infill projects as well as the demand for fitness/wellness facilities, grocery stores and restaurants.

Trend: Increase of For-Sale Inventory

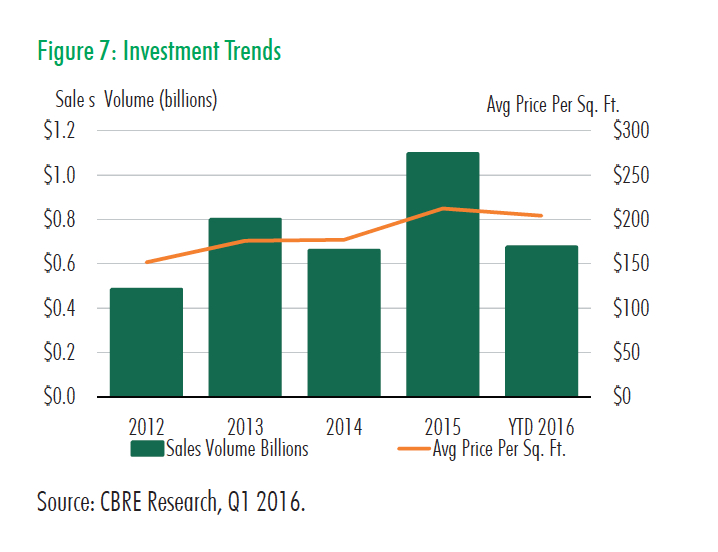

Retail investment conditions proved strong with a total of $674.6 million in transaction volume over 22 properties in the first quarter of 2016.

CBRE Research reports that upcoming retail trends include small scale speculative developments which are said to add an increase of for-sale inventory.

In theory, analysis of market research can prevent the commercial real estate industry from repeating the mistakes of the past. Left unheeded, market research can only provide numbers and statistics. Springing forward into the second quarter of 2016, commercial real estate professionals can take advantage of the trends noted from the previous quarter. “In the end, brokerage is about providing honest, valuable and superior information and access to the best opportunities available at that time,” concludes Ballenger.

Graphs courtesy of CBRE Research

Industrial Photo of Commerce City – By James from Boulder, USA (Flickr.com – image description page) [CC BY 2.0 (http://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons

Retail photo courtesy of Business Rewritten