Denver, CO – The Front Range tech scene is not only expanding but also differentiating, according to CBRE Research’s Colorado Tech Book 2016. In 2015, high-tech companies were the largest leasing industry in metro Denver with 16.5 percent of the total square feet leased (1.1 million square feet). Across Colorado, high-tech encompasses 15.5 million square feet. Colorado’s highly educated workforce is helping to fuel the growth: a July 2016 CNBC ranking recognized the state’s workforce as No. 1 in the nation. CBRE Research also found the state’s relatively affordable cost of living compared to peer markets and strong network of tech companies to be contributors to the industry’s growth.

Amid its growth, Colorado’s tech sector is constantly changing, both as an industry and in terms of its real estate preferences.

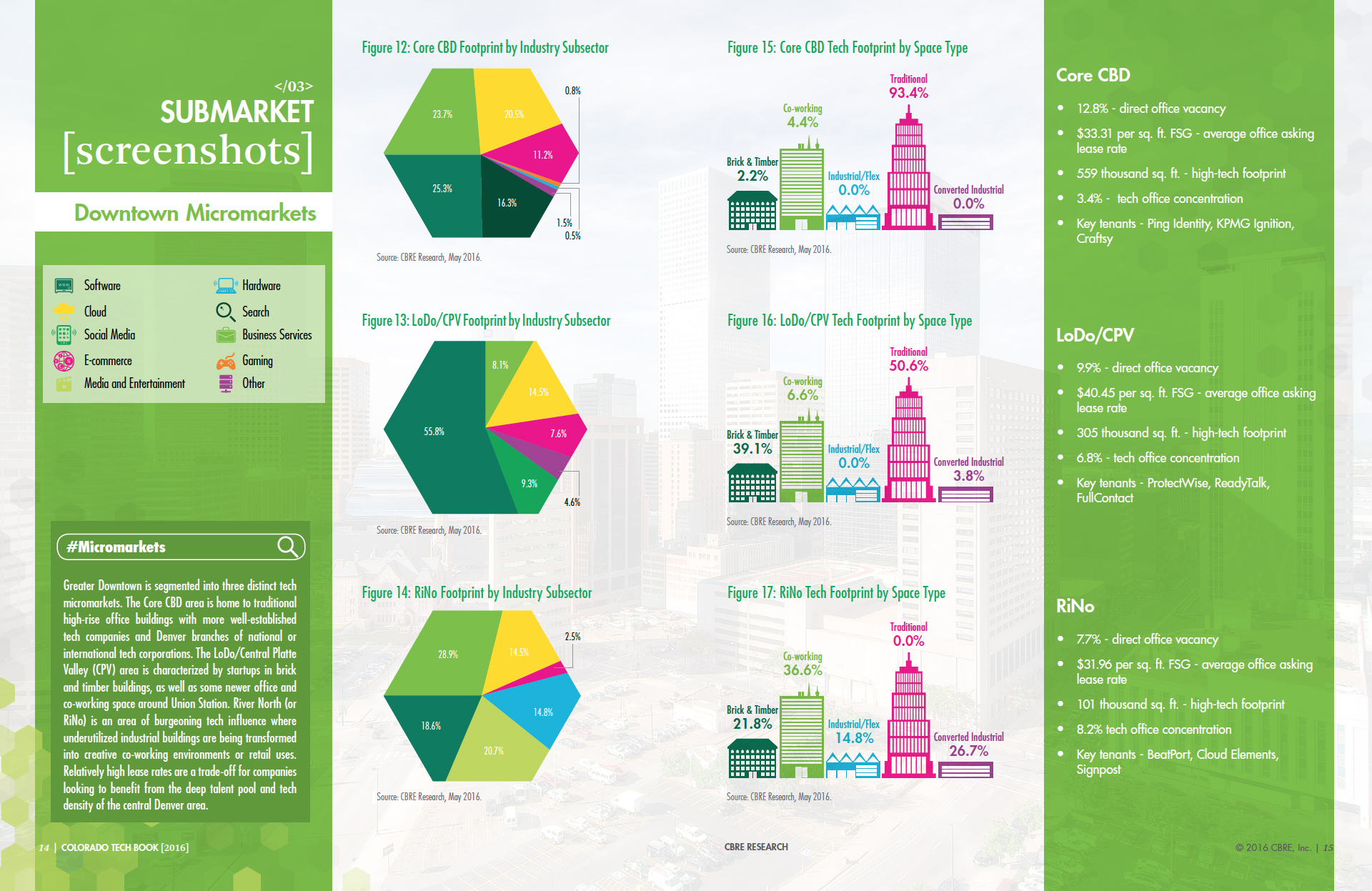

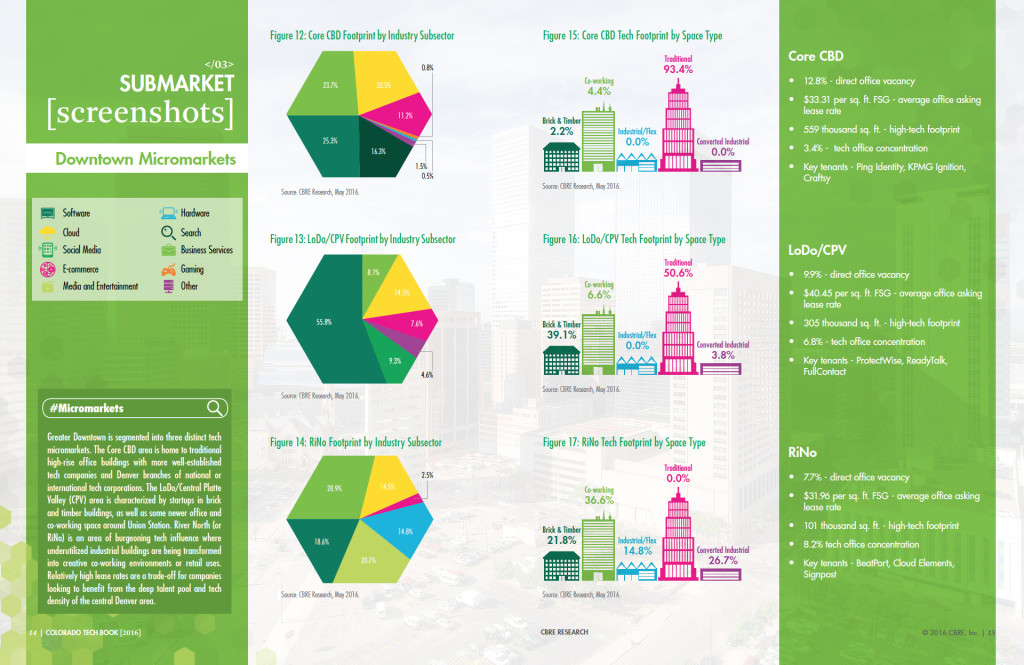

“There is migration from submarket to submarket—for example, Downtown Denver is more tech-focused today than ever—and between property types, with traditional office space still dominating but tech firms now occupying everything from co-working space to industrial/flex buildings,” said Katie Murtaugh, research analyst, CBRE Denver. “The industry’s evolution has led to unique submarket trends in terms of the type and maturity of high-tech companies that locate in specific areas and the format of space they lease.”

“There is migration from submarket to submarket—for example, Downtown Denver is more tech-focused today than ever—and between property types, with traditional office space still dominating but tech firms now occupying everything from co-working space to industrial/flex buildings,” said Katie Murtaugh, research analyst, CBRE Denver. “The industry’s evolution has led to unique submarket trends in terms of the type and maturity of high-tech companies that locate in specific areas and the format of space they lease.”

High-Tech Subsector Profiles

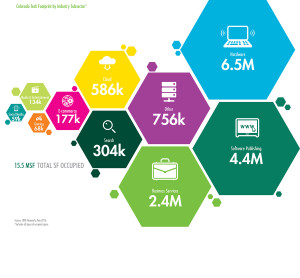

Of Colorado’s 15.5 million square feet occupied by the high-tech industry, defined in this report to cover high-tech services and manufacturing, Hardware companies were the largest real estate occupiers, at 6.5 million square feet. The next highest user is Software Publishing at 4.4 million square feet, followed by Business Services (2.4 million), Cloud (586,000), Search (304,000), E-commerce (177,000), Media and Entertainment (134,000), Gaming (68,000) and Social Media (59,000). Telecommunications and aerospace firms, as well as data centers, were not included in the CBRE study.

Of Colorado’s 15.5 million square feet occupied by the high-tech industry, defined in this report to cover high-tech services and manufacturing, Hardware companies were the largest real estate occupiers, at 6.5 million square feet. The next highest user is Software Publishing at 4.4 million square feet, followed by Business Services (2.4 million), Cloud (586,000), Search (304,000), E-commerce (177,000), Media and Entertainment (134,000), Gaming (68,000) and Social Media (59,000). Telecommunications and aerospace firms, as well as data centers, were not included in the CBRE study.

Subsector diversification varies by submarket. In Greater Downtown Denver, Software, Business Services and Cloud make up a combined 70 percent of the high-tech footprint. In the Southeast, the same three subsectors total 92.9 percent.

“The diversification of Colorado’s high-tech sector comes as a surprise to many people,” said Murtaugh. “Subsectors like Social Media and E-commerce frequently receive a lot of fanfare, but it’s our state’s Hardware, Software Publishing and Business Services tech companies that have the largest footprint. Overall, a diversified tech sector is a healthy sector and the best-positioned to weather any one subsector’s storm.”

High-Tech Space Preferences

In general, the Front Range high-tech footprint is dominated by traditional office space (9 million square feet), followed by industrial/flex space (6 million), before dropping significantly to include brick and timber (324,000), co-working (97,000) and converted industrial (47,000).

Colorado’s submarkets, however, deviate with their own unique space preferences. Although traditional office space is still the leader for high-tech companies located in Greater Downtown Denver, 87 percent of Denver metro’s total co-working space is located downtown. Of the downtown micromarkets, LoDo/Central Platte Valley (CPV) has the largest co-working footprint, but co-working represents the largest share of total office space in RiNo at 36.6 percent.

Traditional office space also leads in the Southeast and Northwest submarkets, where many high-tech firms turn for their larger-format campus operations. In Fort Collins and Colorado Springs, industrial/flex space makes up the large majority of the high-tech footprint at 87.1 percent and 68 percent, respectively.

Submarket Personalities

- CBRE Research found that young high-tech companies (less than 10 years old) tend to concentrate in Boulder and Greater Downtown Denver, whereas mature high-tech firms gravitate toward Denver’s Southeast submarket.

- Downtown Denver is the most popular submarket for headquarters locations with 57 tech companies based there. Yet tech companies downtown tend to have smaller footprints, due in part to the prevalence of co-working space and higher lease rates.

- Tech companies with large footprints have an advantage in the Southeast submarket as modest lease rates provide for financial flexibility. The Southeast is also Denver’s hub for telecom thanks to the Denver Tech Center’s major juncture of fiber optic cable lines.

- The Northwest submarket is home to Colorado’s largest concentration of high-tech companies (36.7 percent or 2.5 million square feet), benefitting from its ability to attract talent from both Denver and Boulder while paying moderately lower lease rates.

- Looking further north, Boulder has the second-highest tech office concentration (25.6 percent or 1.6 million square feet). Colorado’s highest-profile tech hub, Boulder is recognized nationally for its entrepreneurial ecosystem and start-up culture.

“This geo-spatial interpretation of Colorado’s varied tech sectors and submarkets is a first-of-its-kind analysis into the hard data behind one of our fastest-growing industries,” said Alex Hammerstein, senior vice president, CBRE Denver Tech & Media Practice. “Revealing the unique profiles, personalities and preferences of Colorado’s high-tech sectors not only provides valuable insights for companies looking to expand or relocate to our state but also implications for what the future may hold for these tech-friendly submarkets.”

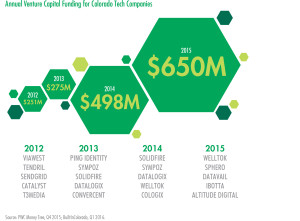

The Colorado Tech Book 2016 also examines the economic impact of the high-tech sector, reviews Colorado’s venture capital funding and provides an outlook for the future of the industry.

The Colorado Tech Book 2016 also examines the economic impact of the high-tech sector, reviews Colorado’s venture capital funding and provides an outlook for the future of the industry.

Images courtesy of CBRE Research