According to a new report from CBRE, data center developers are targeting Aurora and Colorado Springs in their search for land, based on power availability and proximity to enterprise clients, aerospace and defense contractors, and military installations,

Denver is one of the data center markets profiled in CBRE’s biannual report. The Denver metro area is home to 83.3 megawatts (MW) of data center inventory with an additional 8 MW under construction or planned, some of which is preleased. Another 6 MW is under construction in Colorado Springs.

Hyperscale edge deployments made up most of the data center leasing activity in Metro Denver last year. These are smaller, distributed cloud operations designed to move computing closer to the user and reduce the time it takes for data to travel to larger cloud operations in other regions. Looking forward, developers have made large land acquisitions in Aurora and are targeting both Aurora and Colorado Springs for future development.

“Many of the nation’s primary markets are struggling to deliver power at scale on a timely basis, so data center developers are turning to markets that have readily available power and land, like Aurora and Colorado Springs. Colorado also benefits from being the second-largest aerospace economy, with over 400 companies supporting missions related to space and defense that require data center space for data processing and storage. In addition, Colorado is home to seven large military installations, making the state a key location for federal cloud workloads,” said Greg Vernon, senior vice president with CBRE Data Center Solutions in Denver.

Notable Activity in Denver

- Microsoft and QTS Data Centers made large land acquisitions in Aurora.

- IPI Partners-backed Radius Data Centers acquired a downtown Denver data center at 1500 Champa St., to create a carrier-dense colocation offering.

- CoreSite acquired land north of downtown for a new campus.

- The Department of Defense awarded a $9B JWCC contract to Oracle, AWS, Microsoft, and Google, so the DoD can acquire cloud services directly from these providers.

National Trends

CBRE’s latest North American Data Center Trends Report found that tight market conditions and escalating energy and construction costs caused primary-market average asking rents to increase 14.5% year-over-year to $137.90 per kW, the first year-over-year increase in pricing since 2017.

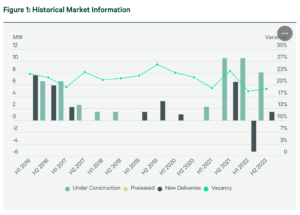

The seven primary U.S. markets* logged 686.9 MW of net absorption, up nearly 40% year-over-year. Despite a 17% increase in supply, vacancy fell to a record-low 3.2%. Two-thirds of the net absorption occurred in the first half of the year, as power and land constraints in certain markets, as well as construction delays, weighed on activity in H2 2022.

“Leasing slowed in the second half of 2022, but this was driven purely by a lack of available space and power constraints,” said Pat Lynch, executive managing director, global head of advisory & transaction services, Data Center Solutions, CBRE. “Demand from enterprise users and cloud service providers remains very strong, particularly as companies continue to adopt hybrid work strategies and prioritize private cloud networks.”

To view the full report, click here.